- Hole V-23-071, collared in a large gap in coverage at the Rogue Project’s Valley deposit, returned 449.7 m averaging 1.77 g/t Au from surface, including 169.2 m of 2.89 g/t Au,surpassing initial MRE block model grade predictions by +36%

- Hole V-23-072 returned 404.8 m averaging 2.27 /t Au, including 100.8 m averaging 4.67 g/t Au from surface, consistent with MRE block model prediction overall and slightly outperforming the model near surface

- Mineralization, including visible gold, encountered in large step-outs in first holes of Phase II program at Einarson Project’s Jupiter target.

Vancouver, B.C., July 24, 2024: SNOWLINE GOLD CORP (TSX-V: SGD) (OTC: SNWGF) (the “Company” or “Snowline”) is pleased to announce analytical results from the first two drill holes of its 2024 exploration campaign and to provide an exploration update from its ongoing 5-drill program in Canada’s Yukon Territory. Hole V-24-071, collared in the high-grade, near-surface section of the Valley deposit, averages 1.77 g/t Au over 449.7 m from surface, including 2.89 g/t Au over 169.2 m. This result exceeds that predicted by the Company’s initial mineral resource estimate (MRE) for Valley by 36% overall. Hole V-24-072 averages 2.66 g/t Au over 295.3 m, including 4.67 g/t Au over 100.8 m from surface, in line with expectation but with slightly (1%) more gold than predicted in the top half of the hole. At the Jupiter target on the nearby Einarson Project, trace visible gold has been encountered in a 174 m step-out from previous holes, along with widespread mineralization. Drilling is ongoing at Valley and on other targets, with assays pending for an additional 13,000 m drilled to date.

Table 1 – Highlight summary of Snowline’s latest assay results. Note that the headline interval for V-24-072 comprises multiple intervals separated by small gaps; see Table 2 for details. *Interval widths reported; true widths of the system are not yet known.

“We are encouraged by such a strong start to our 2024 exploration campaign and excited to have regional drilling underway,” said Scott Berdahl, CEO & Director of Snowline. “Our first two holes of the season at our Rogue Project’s Valley deposit underscore the strength and consistency of the deposit, particularly when it comes to high-grade, near-surface gold mineralization. We eagerly await assay results from the many additional holes drilled within and adjacent to the current deposit, and we look forward to seeing results from additional Valley-style gold targets that are set to be drilled soon.

“I would also like to congratulate Snowline’s team on their exploration success at on our Einarson Project’s Jupiter target, an orogenic gold system, where careful structural mapping and interpretation informed bold step-out holes that meaningfully expand the mineralized footprint of the target, which remains open in all directions. We are excited by these initial observations, and we look forward to the analytical results from current holes along with the rest of the ongoing Phase II drill program at Jupiter.”

VALLEY DRILLING, ROGUE PROJECT

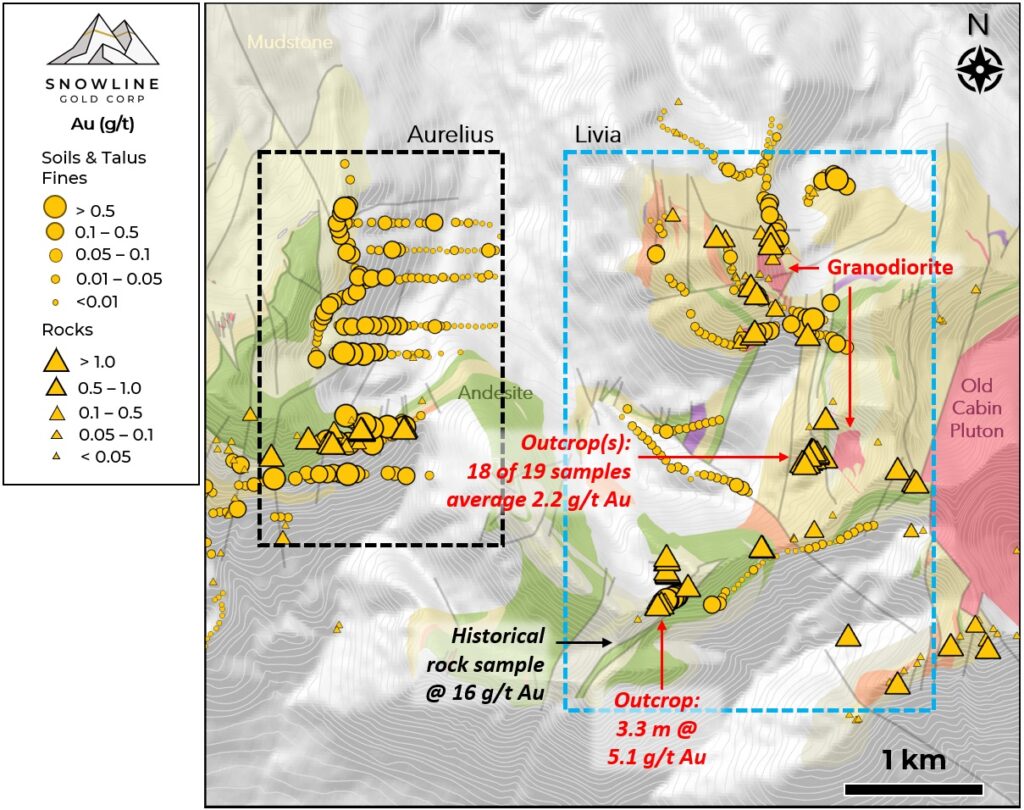

Drilling at the Rogue Project’s Valley deposit is ongoing, with three drill rigs working to upgrade and expand the current resource. To date, roughly 11,000 m have been drilled at Valley in 21 holes along with 3 additional holes in progress. Trace instances of visible gold and sheeted quartz vein arrays have been observed both within and beyond the confines of the current, initial mineral resource estimate for Valley (Figure 1). The Company awaits assay results from the ongoing drill campaign to assess the significance of these observations.

Figure 1 – Plan map of drill results and progress on the Rogue Project’s Valley deposit, highlighting current results in drill holes V-24-071 and V-24-072. Past analytical results are faded, while instances of visible gold in holes awaiting assay are marked by yellow spheres.

Hole V-24-071

Snowline’s first hole of 2024, V-24-071, is collared within a 100 x 200 m gap in previous drill coverage on the Valley deposit (Figure 1). The hole was collared in a mineralized section of the Valley intrusion and remained in continuous mineralization until exiting the intrusion at 434.5 m downhole depth, with lower grades continuing into the surrounding hornfels sedimentary rock (0.24 g/t Au over 22.1 m from 434.5 m downhole).

Figure 2 – Cross-section A, showing V-24-071 in the context of the initial Valley MRE block model and MRE-constraining revenue factor 0.72 pit shell. The block model has not been updated to reflect the current results, and blocks shown outside of the current pit shell constraint are not included in the initial MRE for Valley. Instances of visible gold in holes awaiting assay results are marked by yellow spheres.

The hole averages 1.77 g/t Au over 449.7 m from surface, with the top 169.2 m from bedrock surface (at 6.8 m downhole) averaging 2.89 g/t Au. Within this, a 76.0 m interval from 100.0 m downhole averages 3.50 g/t Au. Of note, applying a 10 g/t Au cut-off does not affect the results (Table 2), given that no assays in the hole returned >10.0 g/t Au. This result emphasizes the consistent and continuous nature of the gold mineralization at Valley.

V-24-071 tests a transitional zone from high grades seen in V-23-061 (519.6 m @ 2.5 g/t Au, including 265.6 m @ 3.6 g/t Au from surface, see Snowline news release dated December 6, 2023) collared 59 m to its southeast into lower, but still highly anomalous, grades seen in V-23-055 (359.4 m @ 1.34 g/t Au from surface, see Snowline news release dated November 9, 2023) collared 49 m to its northwest. In weighting observed grades by sample distance—effectively the amount of gold contained within the drill core—versus that predicted for the hole by the Company’s initial mineral resource estimate, the results outperform the MRE by 36% overall, and by 65% within the top 189.9 m downhole from bedrock surface. This result suggests that the zone of near-surface, high grade mineralization at Valley may be more robust than already understood. The ultimate effect of this result will be quantified along with analytical results of all subsequent holes in an updated mineral resource estimate at a later time.

Hole V-24-072

Hole V-24-072 is also collared in the Valley intrusion, infilling a 92 m gap on section between V-23-039 (553.8 m @ 2.48 g/t Au from surface including 132.0 m @ 4.98 g/t Au, see Snowline news release dated August 3, 2023) and V-23-048 (265.2 m @ 2.2 g/t Au including 100.2 m @ 3.28 g/t Au from surface, see Snowline news release dated September 11, 2023). The hole begins in the high-grade, near surface zone of gold mineralization and ends shortly after exiting the intrusion into surrounding hornfels at 414.5 m downhole.

Figure 3 – Cross-section B, showing V-24-072 in the context of the initial Valley MRE block model and MRE-constraining revenue factor 0.72 pit shell. The block model has not been updated to reflect the current results, and blocks shown outside of the current pit shell constraint are not included in the initial MRE for Valley. Instances of visible gold in holes awaiting assay results are marked by yellow spheres.

Including several short (5-6 m downhole length) barren (<0.1 g/t Au) zones near the bottom of the interval, V-24-072 averages 2.27 g/t Au over 404.8 m from bedrock surface at 3.7 m downhole. The first continuously mineralized interval averages 2.66 g/t Au over 295.3 m, including 100.8 m of 4.67 g/t Au, both from bedrock surface at 3.7 m downhole (Table 2). This high grade, near surface zone is consistent with those seen in surrounding holes (4.98 g/t Au over 132.0 m from bedrock surface in V-23-039, 5.03 g/t Au over 30.2 m from bedrock surface in V-23-048), demonstrating strong continuity of multiple gram-per-tonne gold mineralization within this high-level zone at Valley.

V-24-072 exits the current MRE pit-constraint at approximately 310 m downhole, and thus all intervals below this point, including 17.0 m of 3.98 g/t Au and 42.0 m averaging 1.01 g/t Au are outside of the space considered in the present, initial MRE.

Table 2 – Summary of significant mineralization returned from current holes at Valley. The consistency of strong mineralization on the target is reinforced by the capped values in the rightmost column, wherein any assay result >10 g/t Au is replaced by 10.0 g/t Au to calculate the average interval grades. Note that the headline interval for V-24-072 is a combination of four separate mineralized intervals separated by small (5-6 m) gaps below <0.1 g/t Au. *Interval widths reported; true widths of the system are not yet known, with different vein generations, orientations, and grade distributions present within various intervals through the bulk tonnage gold target at Valley.

EXPLORATION UPDATES

Eagle Mine Incident and Regional Exploration Program

Following the heap leach failure incident at Victoria Gold’s Eagle Mine on June 24th, Snowline has been in ongoing communication with the First Nation of Na-Cho Nyäk Dun (FNNND), within whose Traditional Territory the Rogue and Einarson Projects are located. Snowline recognizes that FNNND’s resources and staff are currently committed to the immediate response to the Eagle Mine incident and ongoing threat of wildfires in the Mayo area. The Company remains respectful and responsive to FNNND’s concerns relating to mining activities and mineral exploration in light of the current situation.

Snowline shares in the concerns held by FNNND relating to the environment, potential impacts and community well-being and has made adjustments to its planned program. The Company is committed to the responsible undertaking of its seasonal exploration activities, while respecting our relationships with First Nations, local communities, our contractors and our workers.

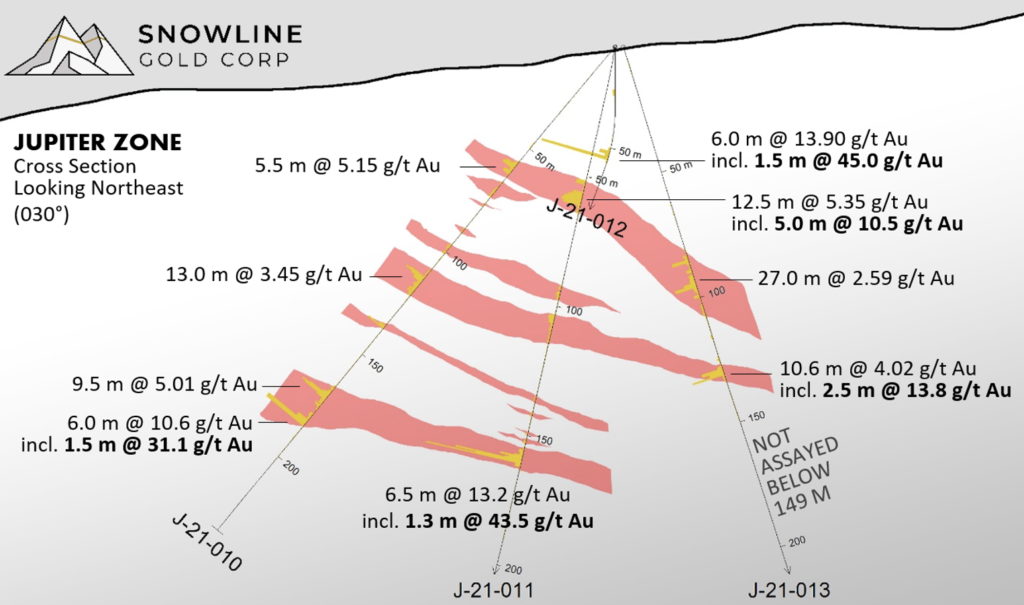

Jupiter Target, Einarson Project

Phase II drilling is underway at the Company’s Jupiter target, following up on the drill discovery by Snowline of an extensive orogenic gold system at Jupiter in 2021 (see e.g. Snowline news release dated January 12, 2022) and the recent consolidation of the Einarson project (see Snowline news release dated April 25, 2024). The first four drill holes of the 2024 campaign are complete, with assays pending for roughly 1,500 m from the target and drilling ongoing.

Figure 4 – Visible gold in a fractured quartz carbonate vein in J-24-024, the southernmost hole drilled at the Einarson Project’s Jupiter target to date. The occurrence, at 256.2 m downhole depth, is roughly 1.2 km along strike from the northernmost hole, J-21-020, which also encountered visible gold (8.3 g/t Au over 4.7 m downhole, see Snowline news release dated January 12, 2022). The vein is roughly 5 cm true width and sits atop an 8 m interval of clay alteration in the hanging wall of a fault zone.

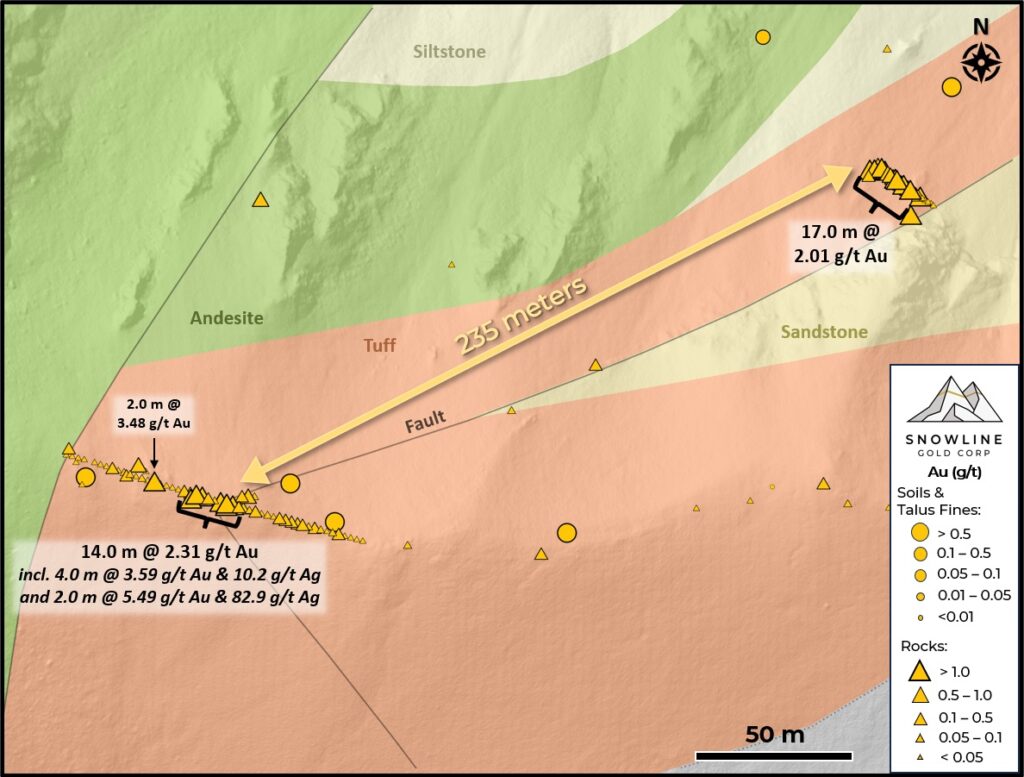

Following detailed surface mapping and structural interpretation, the new drillholes test the southeastern end of the system, both as step-backs across the width of the system and as step-outs along strike (Figure 5). The holes are successful in demonstrating additional mineralized structures to the east of the structures intersected in Phase I drilling in 2021, expanding the known width of the system by at least 200 m, showing continuity to depth and demonstrating an increased strike length of known mineralization. Assays are pending for all holes drilled at Jupiter in 2024.

Figure 5 – Simplified schematic geological map (left) and cross section (right) of the Jupiter target, showing the locations of the four holes drilled to date in 2024. Note the multiple structures identified, expanding the breadth of the Jupiter system, and the continuity of strong mineralization encountered at depth. “Mineralization” denotes areas of patchy, veinlet-hosted and/or disseminated sulphides in vein wall rocks. The system remains open in all directions, with only 1.2 km of strike length partially drill tested to date within a broader 3 km zone of elevated (>10 ppb Au) to anomalous (>50 ppb Au) soil geochemistry.

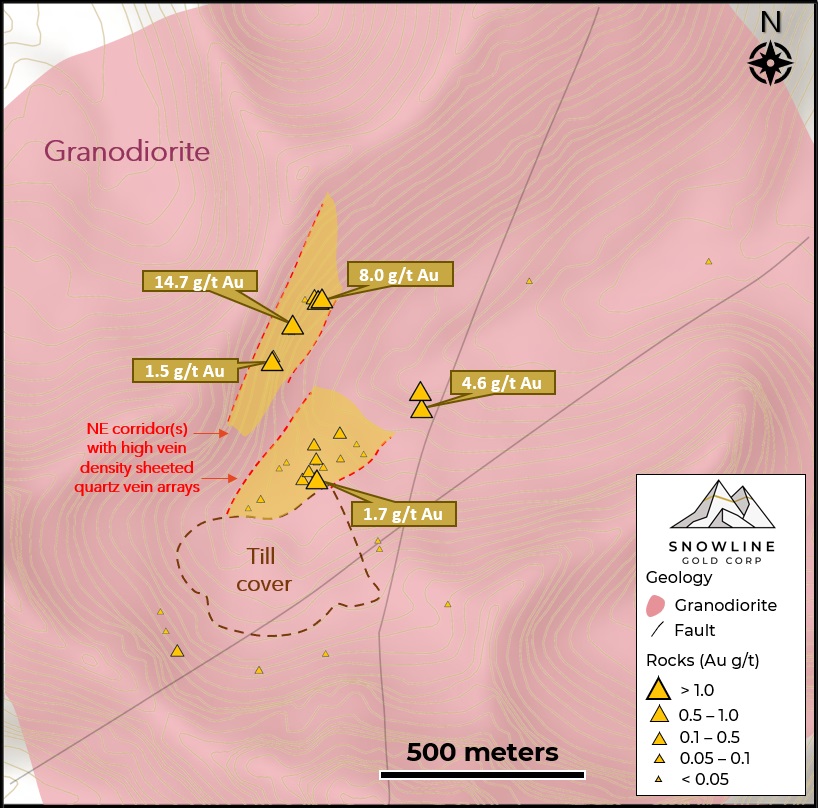

Cujo Target, Rogue Project

At the Cujo target, roughly 32 km west of Valley, a 3-hole, 1,067 m Phase II drill program has been completed. Drilling intersected broad zones of sheeted quartz vein mineralization hosting minor amounts of bismuthinite. Visible gold was not observed during logging. Interestingly, a 50-cm dyke of fine-grained porphyritic intrusive was observed in CU-24-003, the first hole of the season at Cujo. This dike is similar in appearance and character to a porphyritic intrusive phase at the Valley target that is thought to be a primary factor in driving the unusually high-grade gold mineralization at that target. The Company views the presence of this unit at the Cujo target as a promising indicator for regional prospectivity across the Rogue Plutonic Complex. Assays are pending for all holes at Cujo.

Following completion of the Cujo drill program, the drill rig has mobilized to the Rogue project’s Aurelius target for Phase I drilling on the newly delineated target (see Snowline news release dated February 20, 2024).

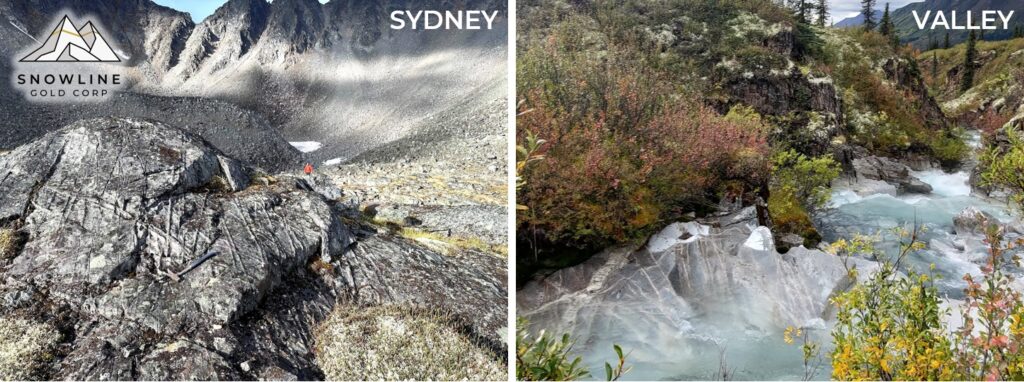

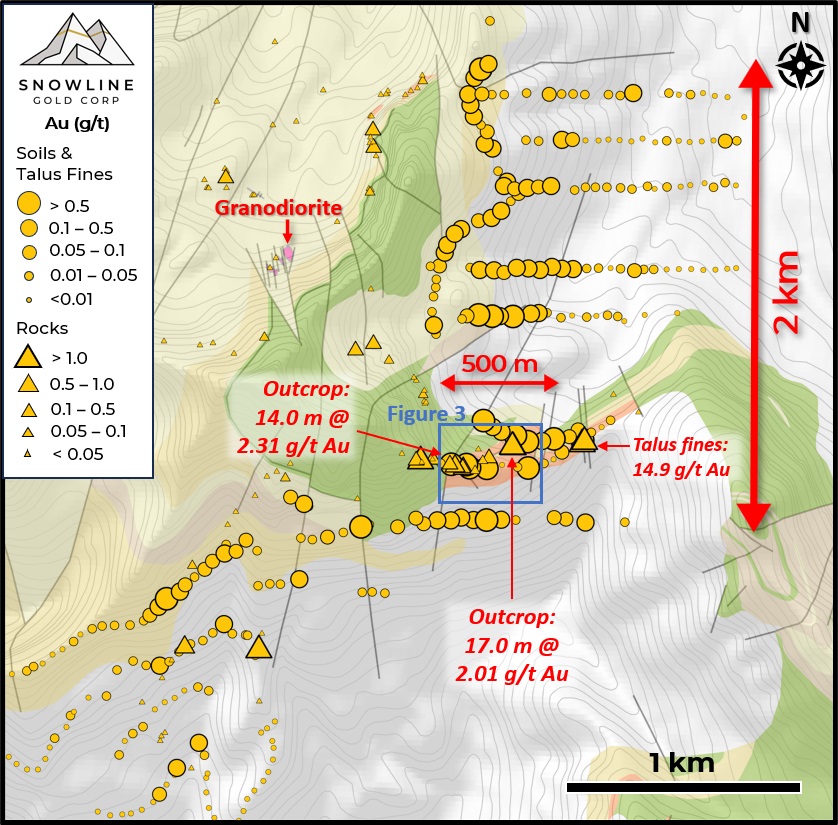

Sydney Target, Cynthia Project

At the Sydney target on the Cynthia Project, located roughly 24 km south of Valley, a 72 m outcrop surface channel sampling program has been completed, targeting the high-density (>10 veins/m) quartz vein arrays present on surface over a 900 x 500 m area. One instance of visible gold was found in outcrop during this sampling program, the first observation of visible gold at this new target and Snowline’s sixth discovery of visible gold on a distinct exploration target in the vicinity of Valley. Assays for this sampling program are pending and will be used to prioritize Sydney against other potential targets for near-term drill testing.

Figure 6 – High quartz vein densities with multiple vein orientations in outcrop at the Cynthia Project’s Sydney target (left) and the Rogue Project’s Valley target (right), highlighting similarities between the two.

WARRANTS & RSUs

Snowline announces the early exercise of 1,171,146 warrants, for proceeds to the Company of CDN $2,927,865. The warrants were initially set to expire in August 2024. Following this exercise, Snowline has only 200,000 additional warrants outstanding, at a strike price of $3.50.

In addition, following the recent appointment of Gil Lawson to the Board of Directors as an Independent Director, the Company has issued 75,000 deferred share units (DSUs) as a long-term equity incentive in accordance with the Company’s Omnibus Incentives Plan. The DSUs will not vest until the recipient ceases to be a Director of the Company.

QA/QC

On receipt from the drill site NQ2-sized drill core was systematically logged for geological attributes, photographed and sampled at Snowline’s “Forks” Camp. Sample lengths as small as 0.5 m were used to isolate features of interest, but most samples within moderate to strong mineralization were 1.0 m in length; otherwise, a default 1.5 m downhole sample length was used. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently, dictated by orientation line where present or by dominant vein orientation where absent) collected for analysis and one half stored as a record. Field duplicates were collected at regular intervals as ¼ core samples by splitting the ½ core sent for sampling, leaving a consistent record of half core material from duplicate and non-duplicate samples alike. Standard reference materials and blanks were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor to Bureau Veritas’ preparatory facility in Whitehorse, Yukon. Sample preparation was completed in Whitehorse, with analyses completed in Vancouver.

Bureau Veritas is accredited to ISO/IEC 17025 and ISO9001 for quality management. Samples were crushed by BV to >85% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. A four-acid digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 59-element analysis on 0.25 g sample pulps (BV code: MA250). All samples were analysed for gold content by fire assay with an atomic absorption spectroscopy (AAS) finish on 30 g samples (BV code: FA430). Any sample returning >10 g/t Au was reanalysed by fire assay with a gravimetric finish on a 30 g sample (BV code: FA530).

For the purposes of this release, contiguous mineralized intervals are defined as runs of mineralization with no break >5.0 m assaying <0.1 g/t Au, including any subsections thereof. The headline interval in V-24-072 (404.8 m of 2.3 g/t Au) is a composite of four intervals and the intervening 6, 6 and 5 m gaps of <0.1 g/t Au materials, as seen in Table 2.

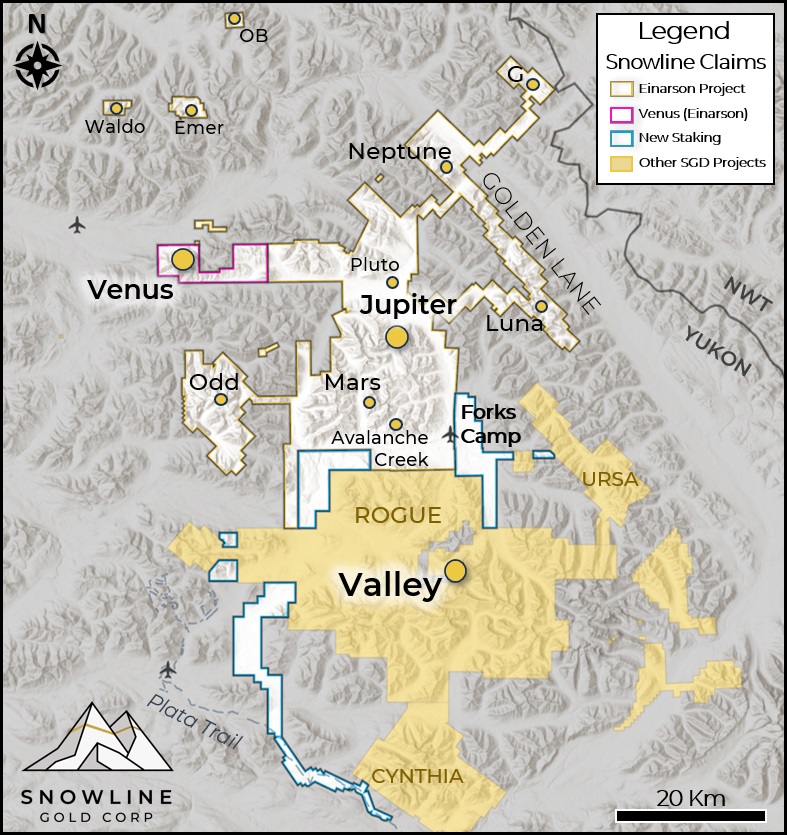

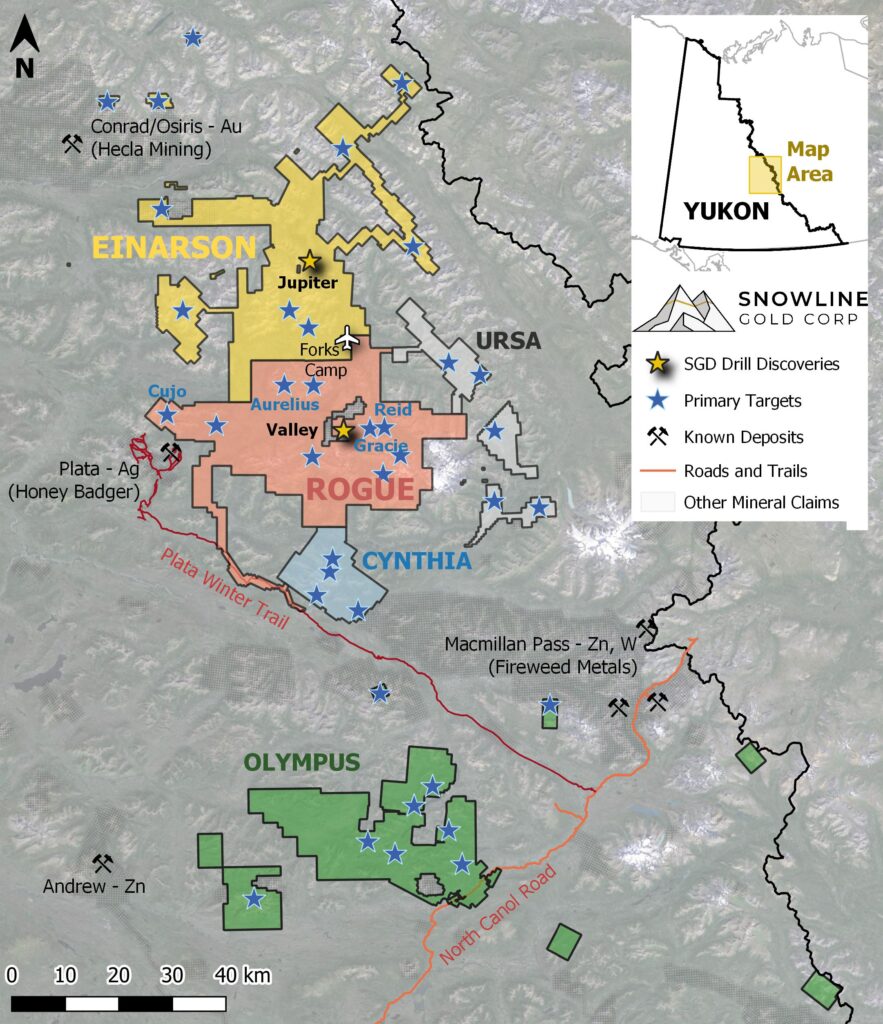

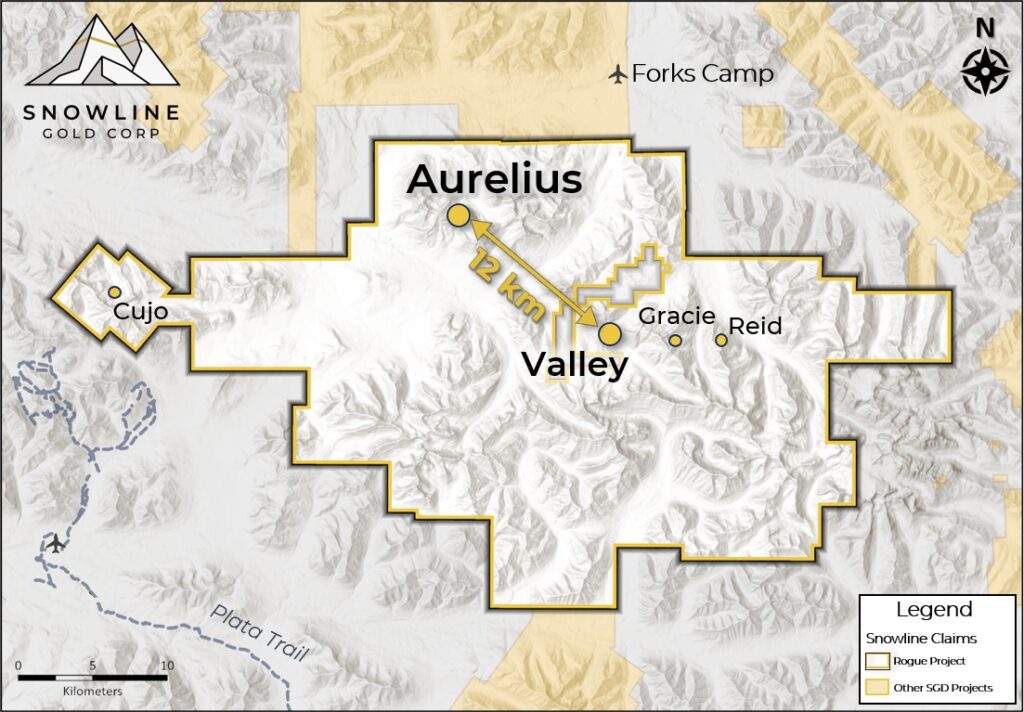

ABOUT ROGUE

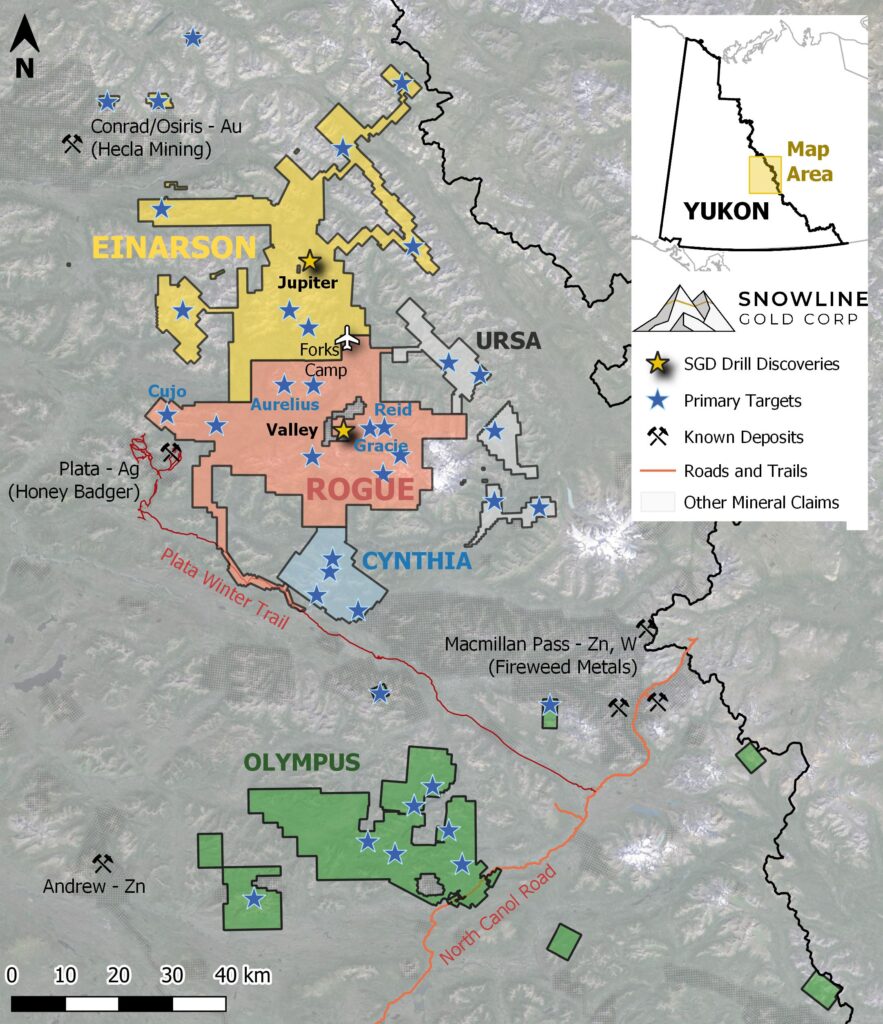

Snowline Gold’s 100%-owned Rogue Project, in Canada’s Yukon Territory, covers a 60 x 30 km cluster of intrusions in the eastern Tombstone Gold Belt known as the Rogue Plutonic Complex.

Since its launch in 2021, Snowline has progressed the Rogue Project’s Valley target from a greenfield prospecting discovery to a significant bulk tonnage gold resource, with 4.05 Moz gold indicated mineral resource at 1.66 g/t Au and an additional 3.26 Moz inferred mineral resource at 1.25 g/t Au within a pit-shell constraint (see Snowline news release dated June 17, 2024). Exploration of the open Valley system is ongoing. Valley is a reduced intrusion-related gold system (RIRGS), geologically similar to multi-million-ounce RIRGS deposits currently in production, like Kinross’s Fort Knox Mine in Alaska, but with substantially higher gold grades. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays within and along the margins of a one-kilometer-scale, mid-Cretaceous aged Mayo-series intrusion.

The Rogue Project area hosts multiple intrusions similar to Valley (Figure 6) along with widespread gold anomalism in stream sediment, soil and rock samples. Elsewhere, RIRGS deposits are known to occur in clusters. For these reasons, Snowline considers the Rogue Project to have district-scale potential to host additional reduced intrusion-related gold systems.

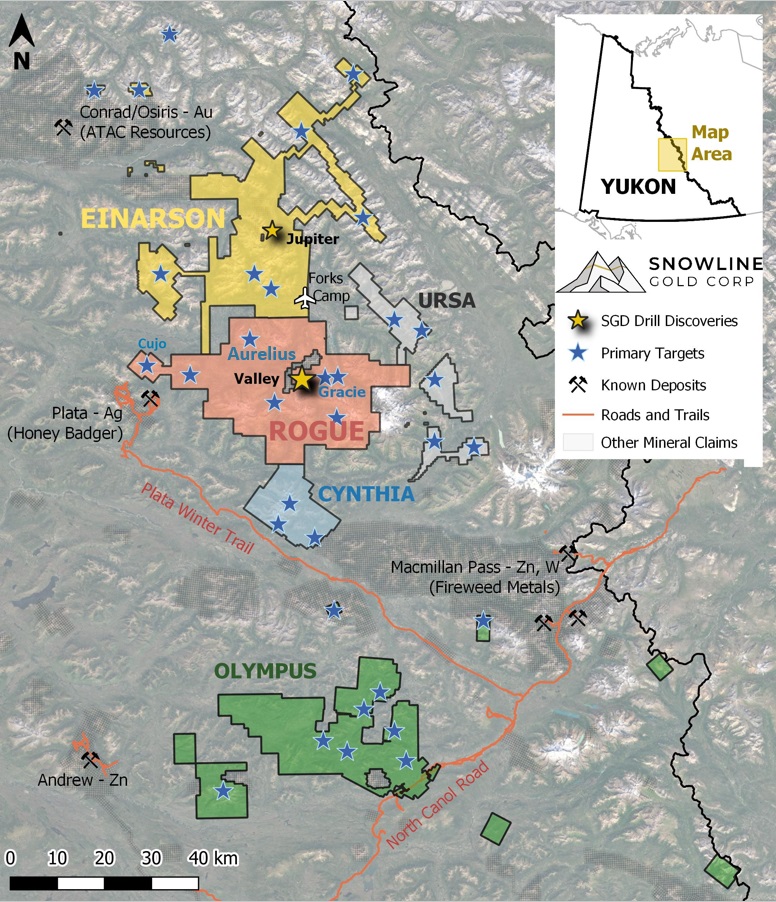

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with an eight-project portfolio covering roughly 360,000 ha (3,600 km2). The Company is exploring its flagship 111,000 ha (1,110 km2) Rogue gold project in the highly prospective yet underexplored Selwyn Basin. Snowline’s project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits. The Company’s first-mover position and extensive exploration database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

Figure 7 – Project location map for Snowline Gold’s eastern Selwyn Basin properties: Rogue, Einarson, Ursa, Cynthia and Olympus. The Valley target is one of several prospective reduced intrusion-related gold targets on the broader 30 x 60 km Rogue Project.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by Thomas K. Branson, M.Sc., P. Geo., VP Exploration of Snowline Gold Corp, as Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the significance of analytical results, the significant of visual drill core observations, the discovery potential within the Valley intrusion and on other exploration targets, the potential for investors to participate in multiple future discoveries, the Rogue project having district-scale prospectivity, the creation of a new gold district and the Company’s future plans and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company’s plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.