- 1172 new claims staked adding 23,229 hectares across three existing projects

- Expands total Yukon land position by 22% to roughly 127,300 hectares

- New, centrally located 45-person camp under construction in preparation for 2022 field season

- Drill program scheduled to commence June 1

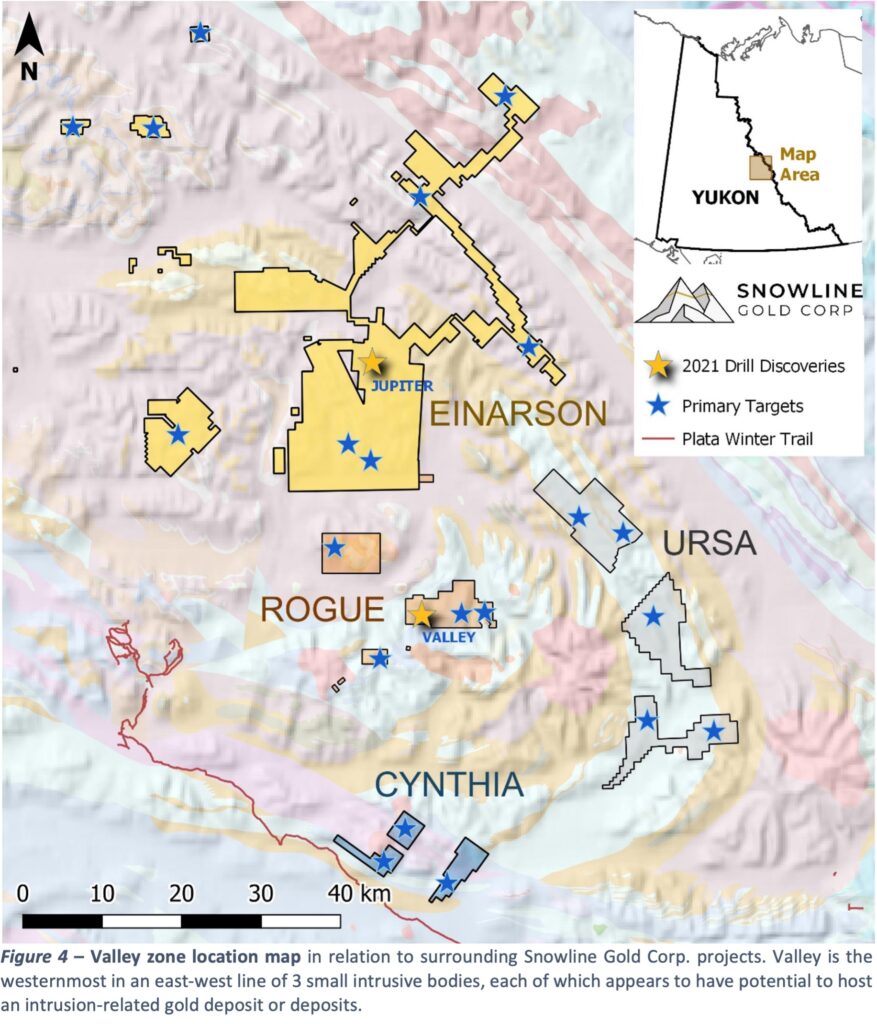

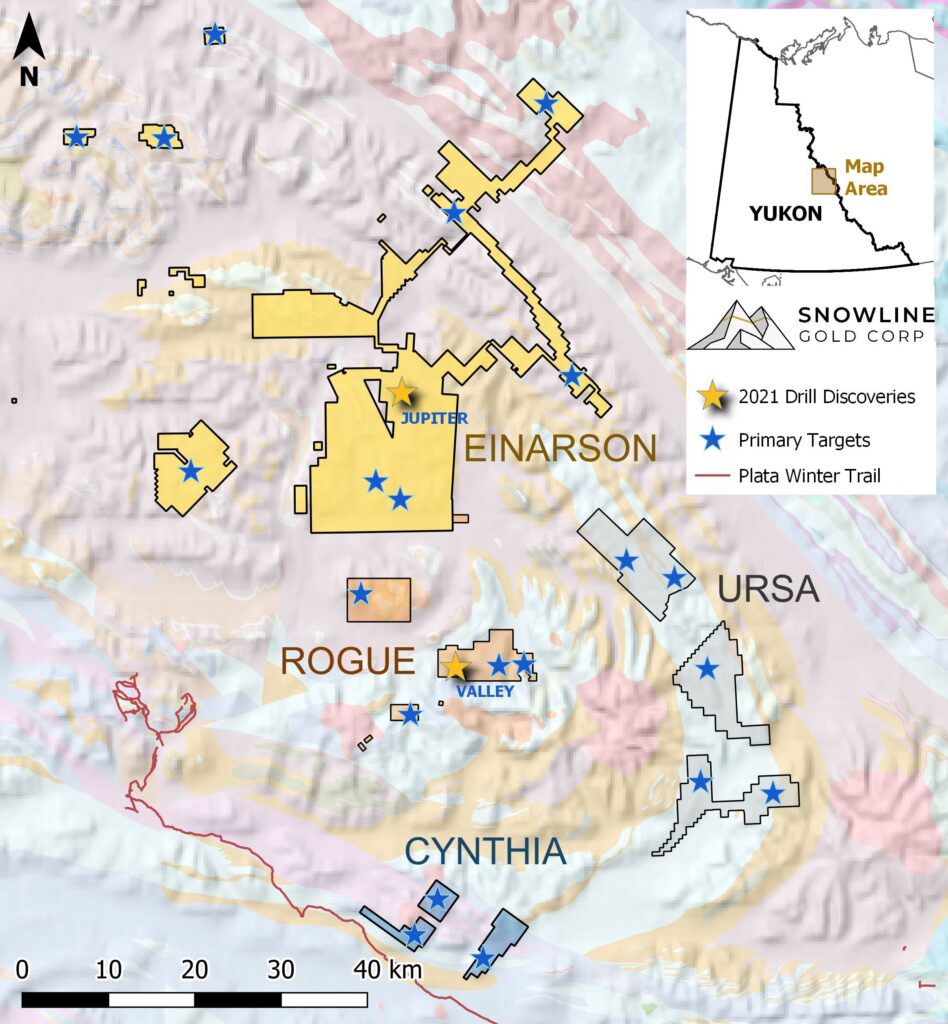

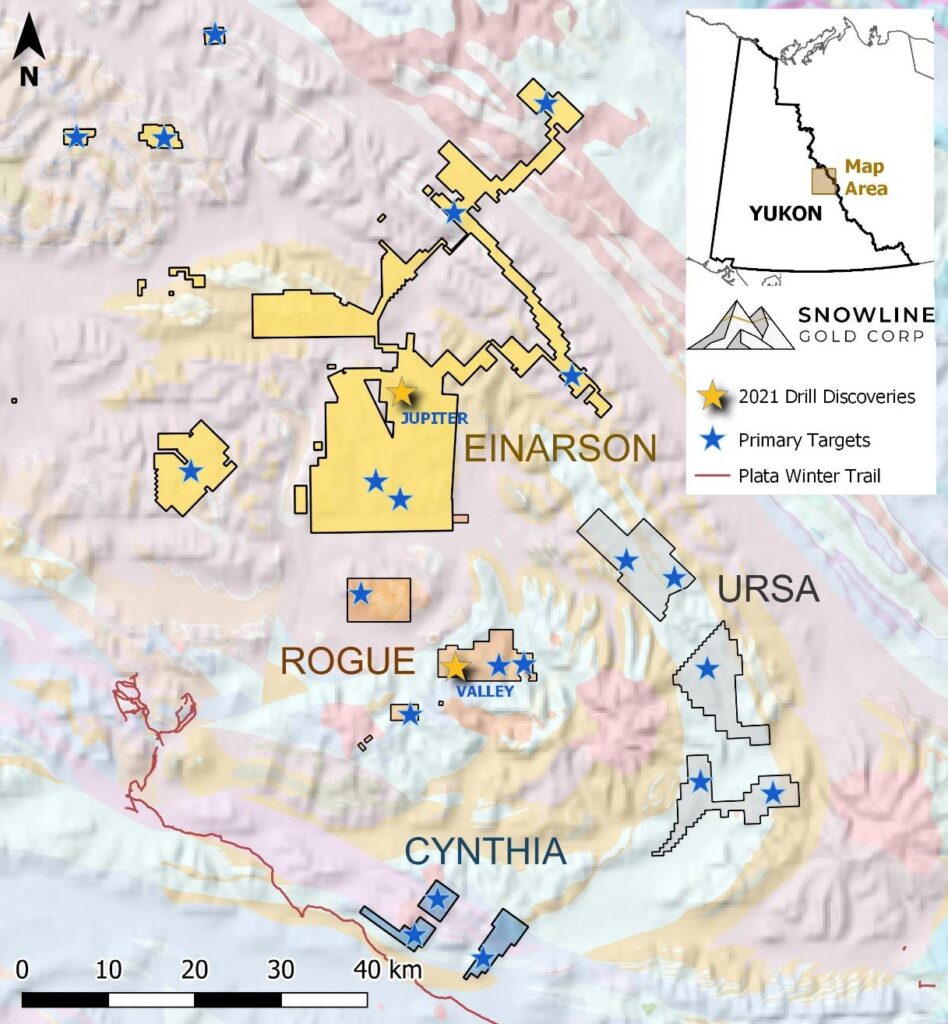

Vancouver, B.C., May 25, 2022 SNOWLINE GOLD CORP. (CSE: SGD)(US OTC: SNWGF) (the “Company” or “Snowline”) is pleased to announce that it has expanded its 100% owned Rogue and Cynthia projects in the east central Yukon through staking. In total, 1,172 new claims were staked covering 23,229 hectares (232 km2), bringing the company’s Yukon mineral tenure holdings to 127,310 hectares (1,273 km2) across its seven projects. Claims were staked to bolster existing property positions following the Company’s recent drill and surface sampling discoveries. The claims cover additional geochemical anomalies and connect properties, which will enhance exploration efficiency. The increased land position further solidifies Snowline’s competitive advantage in an emerging gold district that hosts multiple gold discoveries and mineralization styles.

“Our successful exploration campaign in 2021 demonstrated a high level of mineral potential in a previously underappreciated and sparsely explored region,” said Scott Berdahl, CEO and director of Snowline Gold. “This targeted expansion reflects our renewed, results-based conviction behind our exploration thesis. It cements our first-mover position as we aim to explore not just a discovery, but a potential new gold district. Our soon-to-begin 2022 exploration program will build on last season’s discoveries alongside first-ever drill testing of multiple new targets.”

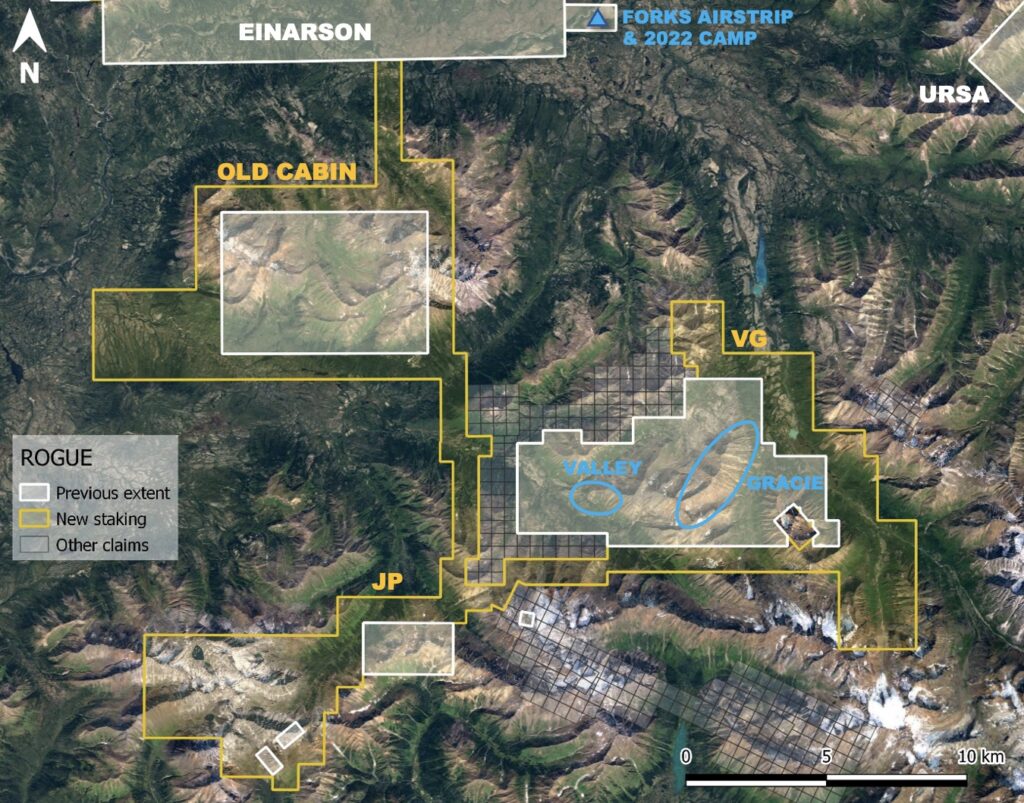

Snowline has also commenced construction of its new 45-person camp, centrally located between the Company’s Jupiter and Valley drill discoveries and proximal to additional prospective targets including Gracie, Ursa and Avalanche Creek. The camp is permitted for the next five field seasons and is located adjacent to the pre-existing Forks airstrip.

“By improving the Forks Airstrip to a safe length and condition, we can transition from float to wheeled planes, increasing our payload by up to 40% per flight and reducing total flights,” said Steve Rennalls, Operations Manager for Snowline Gold. “At the same time, the new camp’s central location shortens flight time to targets, resulting in a smaller environmental footprint through reduced emissions. It also allows for up to 10% more daily field hours per person, and it simplifies drill support, all of which will help to reduce our ‘dollars-per-meter’ operational costs. And despite record snow levels, we have a jump on the season. We are on track to welcome geologists and drillers to the new camp on May 27 with the goal of commencing our 2022 drill program on June 1.”

ROGUE STAKING

Expanded 2.4 times to 22,045 hectares.

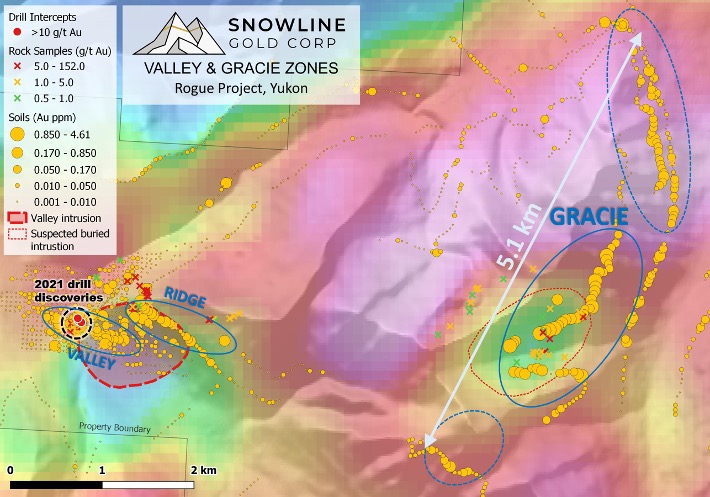

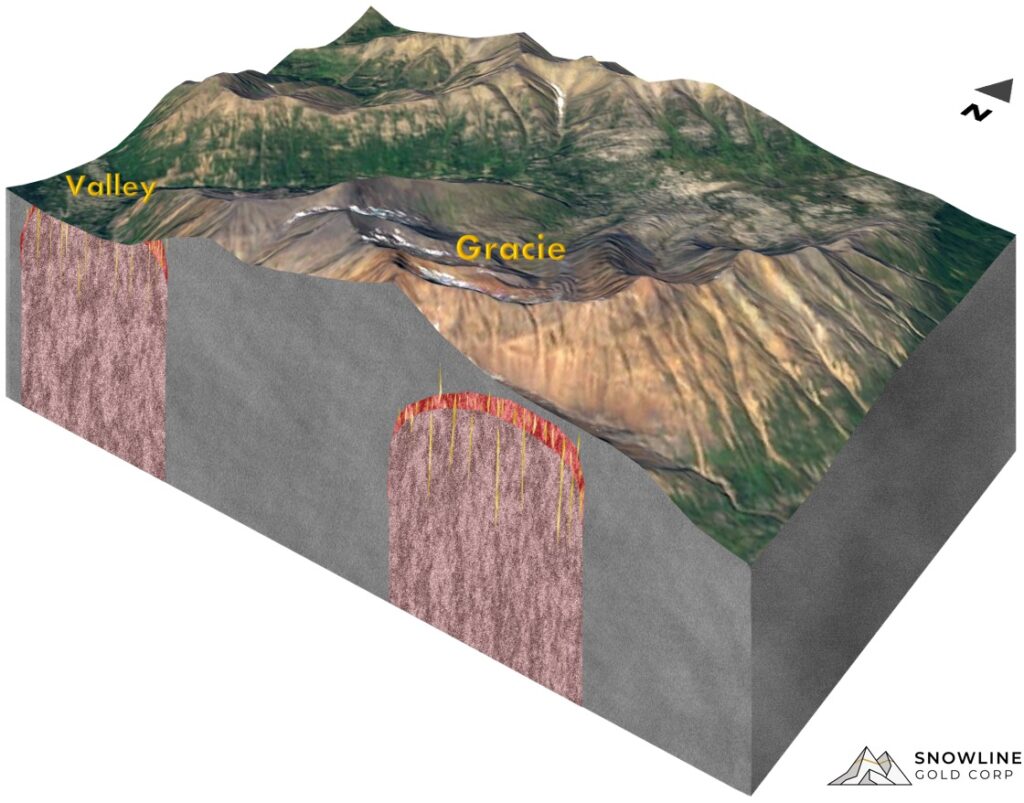

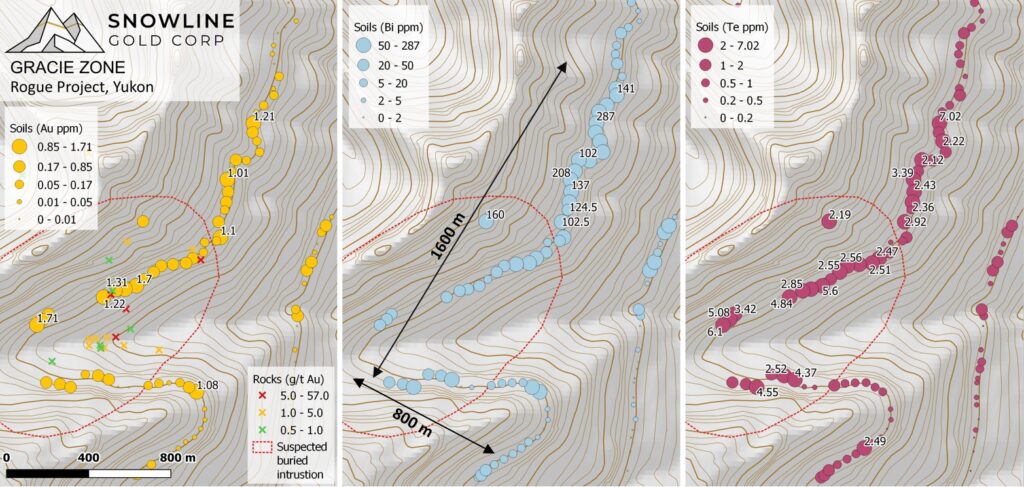

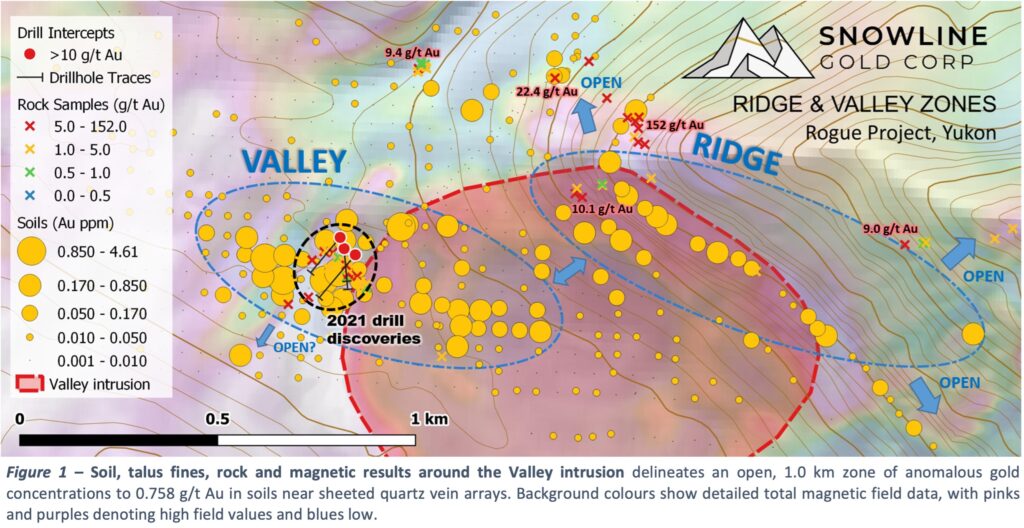

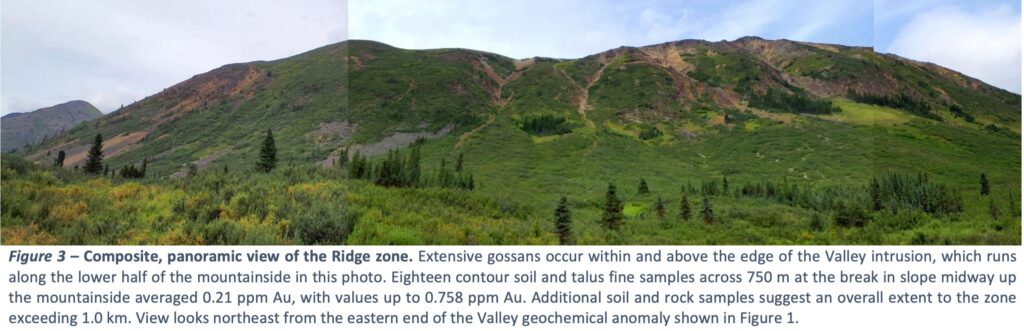

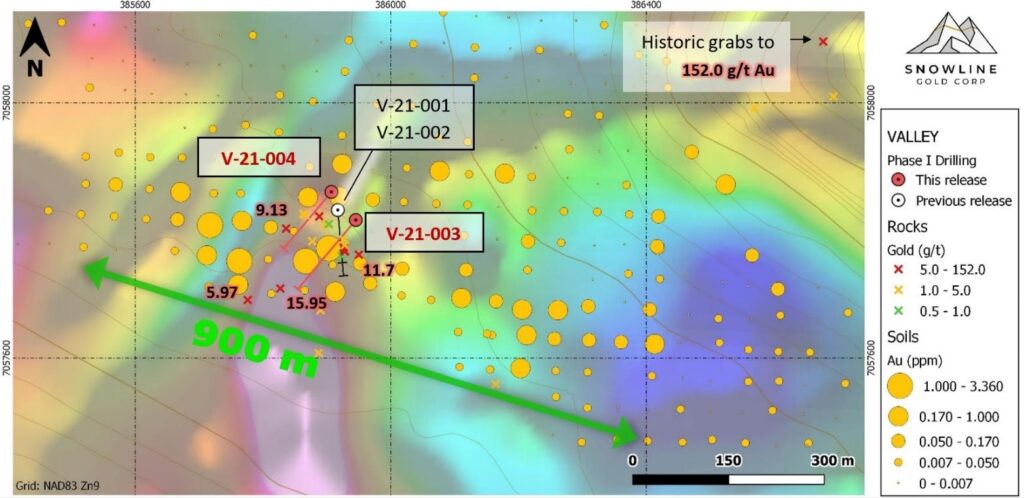

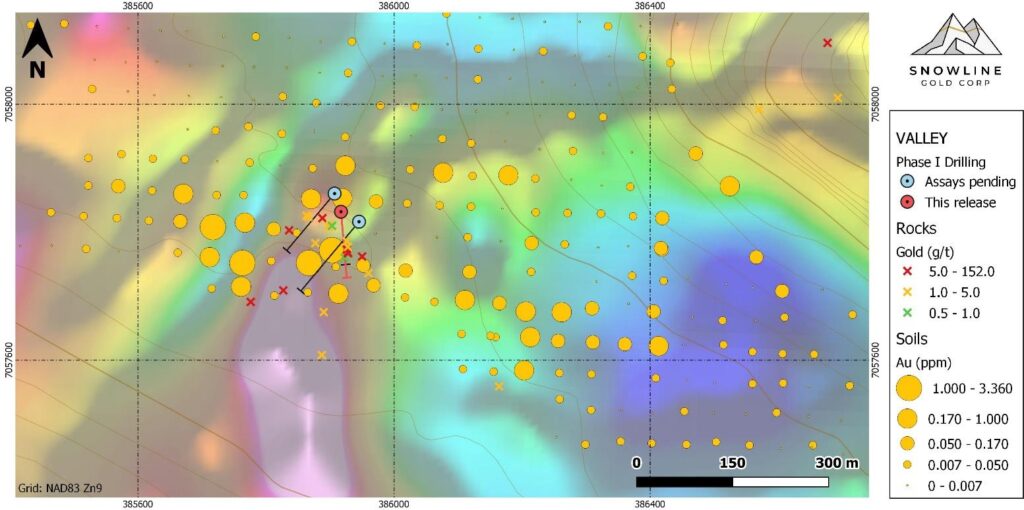

Figure 1 – Newly staked claims on the Rogue project connect previously separate claim blocks, cover additional prospective ground and offer protection against competitive encroachment on known targets.

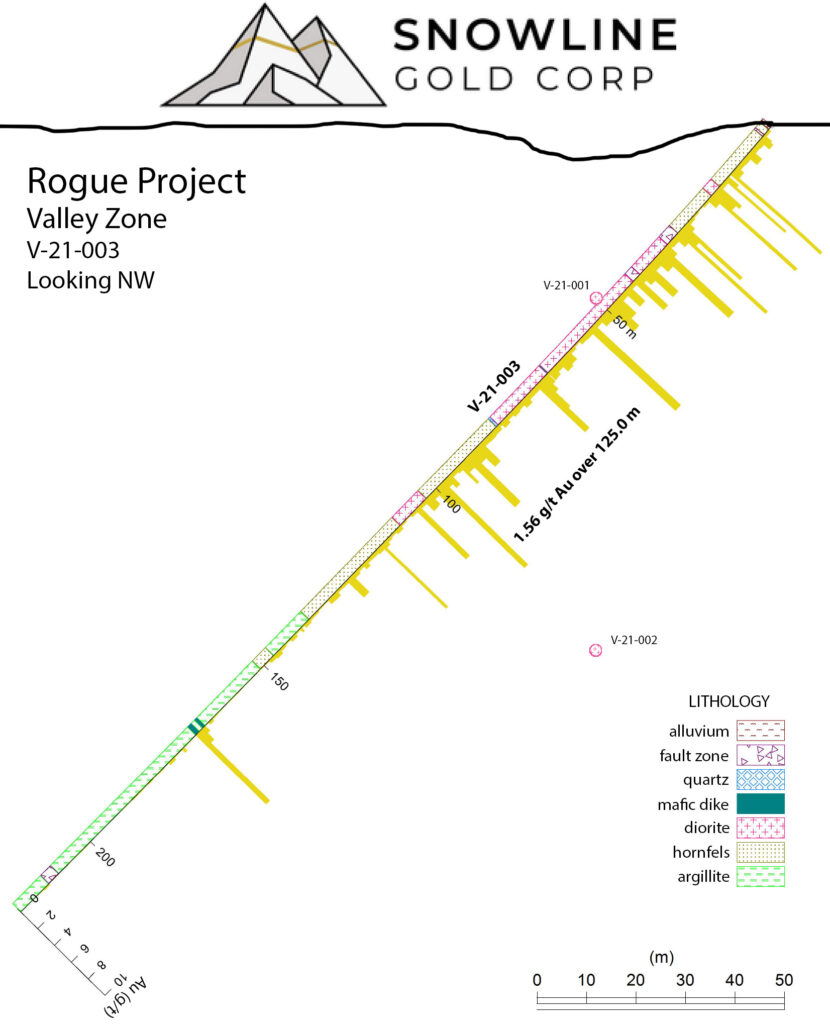

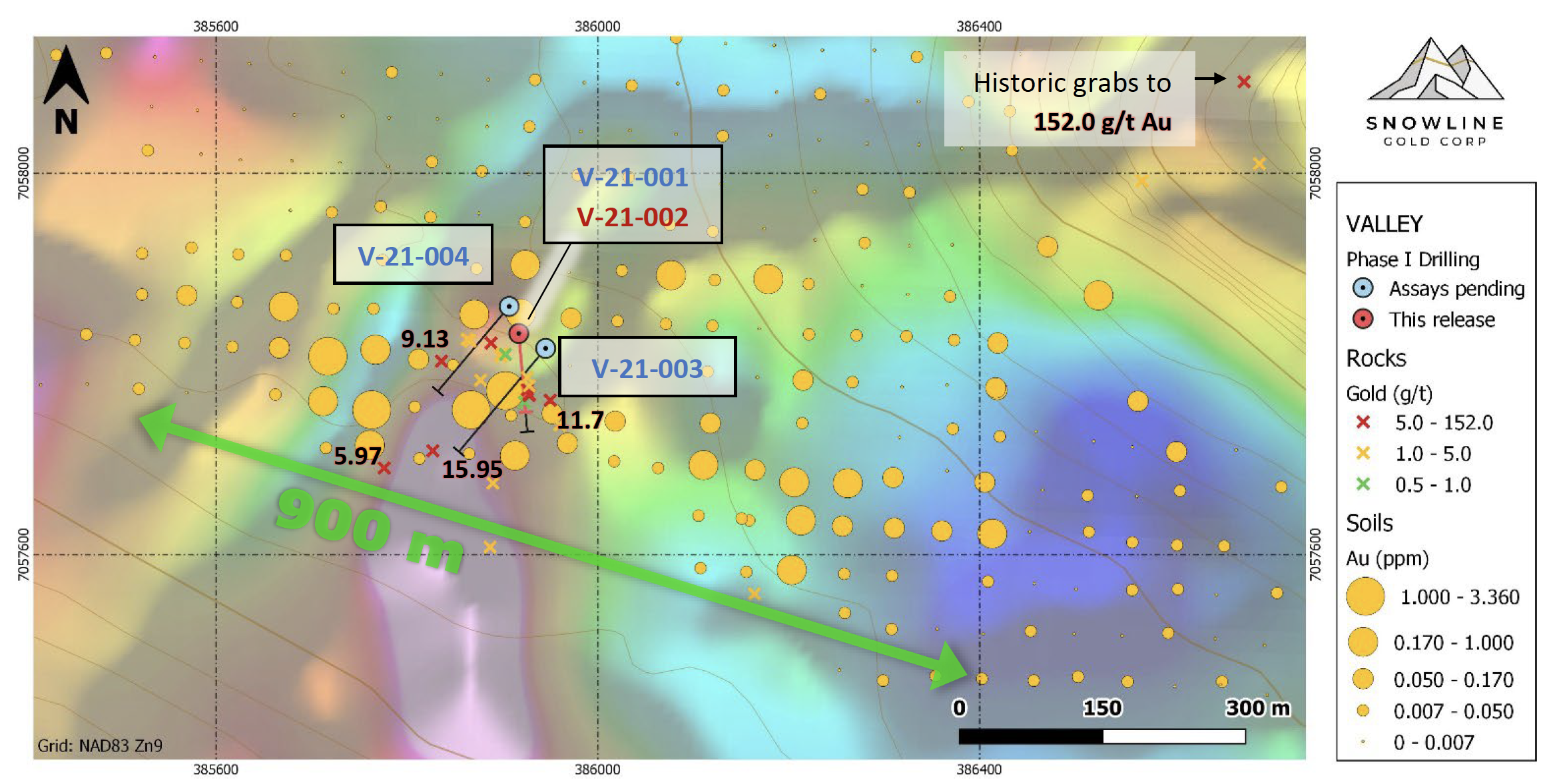

Staking at Rogue expanded Snowline’s tenure around its Valley drill discovery and its Gracie anomaly as well as around several additional exploration targets. Expanded claim positions were selected based on geology, field observations and data contained within Snowline’s extensive regional database. Previously isolated land tenure positions at Rogue were connected, allowing for efficient allocation of exploration expenditures towards annual claim assessments across different areas.

CYNTHIA STAKING

Expanded 2.9 times to 14,326 hectares.

Figure 2 – Newly staked claims on the Cynthia project redefine the scope of the prospect, connecting the Cynthia/X zones with the REA claims and covering historical anomalies for both gold and zinc. The broader claim block boundaries were selected based on a combination of public and proprietary geochemical data.

The Cynthia project was expanded by nearly 3 times, connecting the Company’s original Cynthia claim block with nearby mineral claim blocks currently under option from Epica Gold Inc., a subsidiary of HighGold Mining Inc. The expanded claim position covers potential sources of elevated gold content in historical soil and silt samples, including bulk-leach extractable gold samples, that are present across a wide area. Elevated zinc values are also present in historical soil and silt samples. The underlying geology at Cynthia is thought by the Company to be prospective for multiple deposit types, with two mid-Cretaceous Mayo series intrusions of the Rogue plutonic complex intruding a structural transition zone present in Selwyn Basin stratigraphy.

EINARSON STAKING

Various fractional claims were staked on the Einarson project as part of the Spring 2022 staking campaign to consolidate land positions and reduce the potential for “nuisance staking” in the vicinity of key target areas.

AREAS OF INTEREST

Certain newly staked claims fall within the areas of interest (AOIs) defined in Snowline (formerly Skyledger Tech Corp)’s December 1, 2020 deal with Yukon-based company 18526 Yukon Inc., through which Snowline acquired its extensive Yukon datasets and its seven Yukon mineral properties. Claims staked within the AOIs are subject to a 2% net smelter return (NSR) and are incorporated into existing buy-down provisions which allow Snowline to reduce NSR to 1% on a project-by-project basis. 18526 Yukon Inc. is a privately held project generation company that is owned 40% by Snowline’s CEO and Director Scott Berdahl.

QUALIFIED PERSON

Information in this release has been prepared and approved by Scott Berdahl, P. Geo., Chief Executive Officer of Snowline and a Qualified Person for the purposes of National Instrument 43-101.

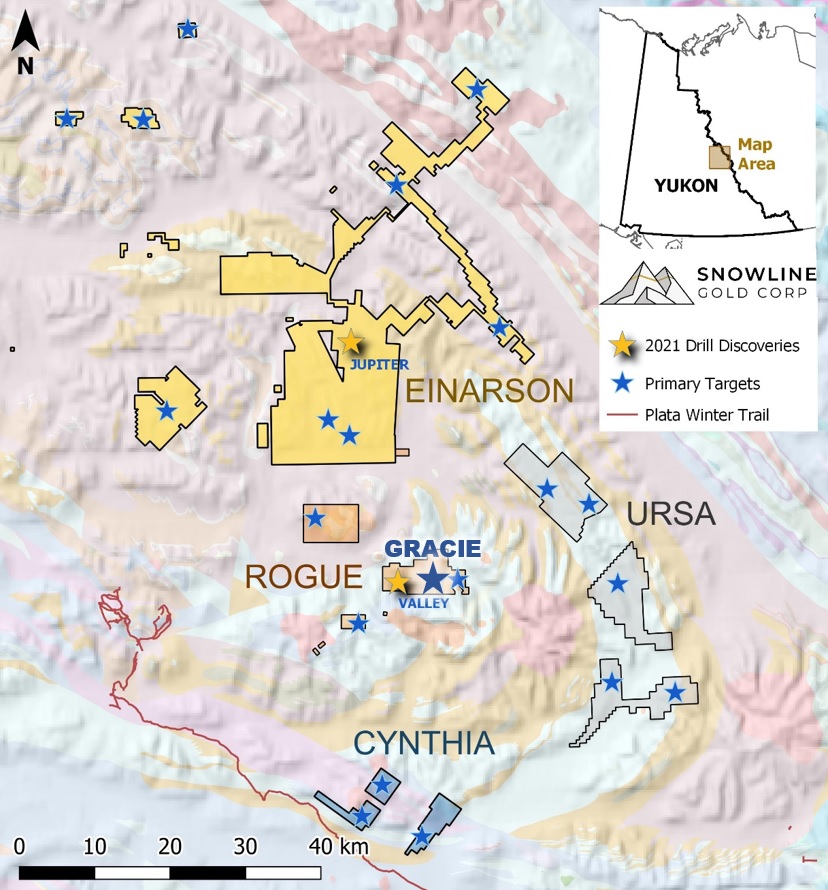

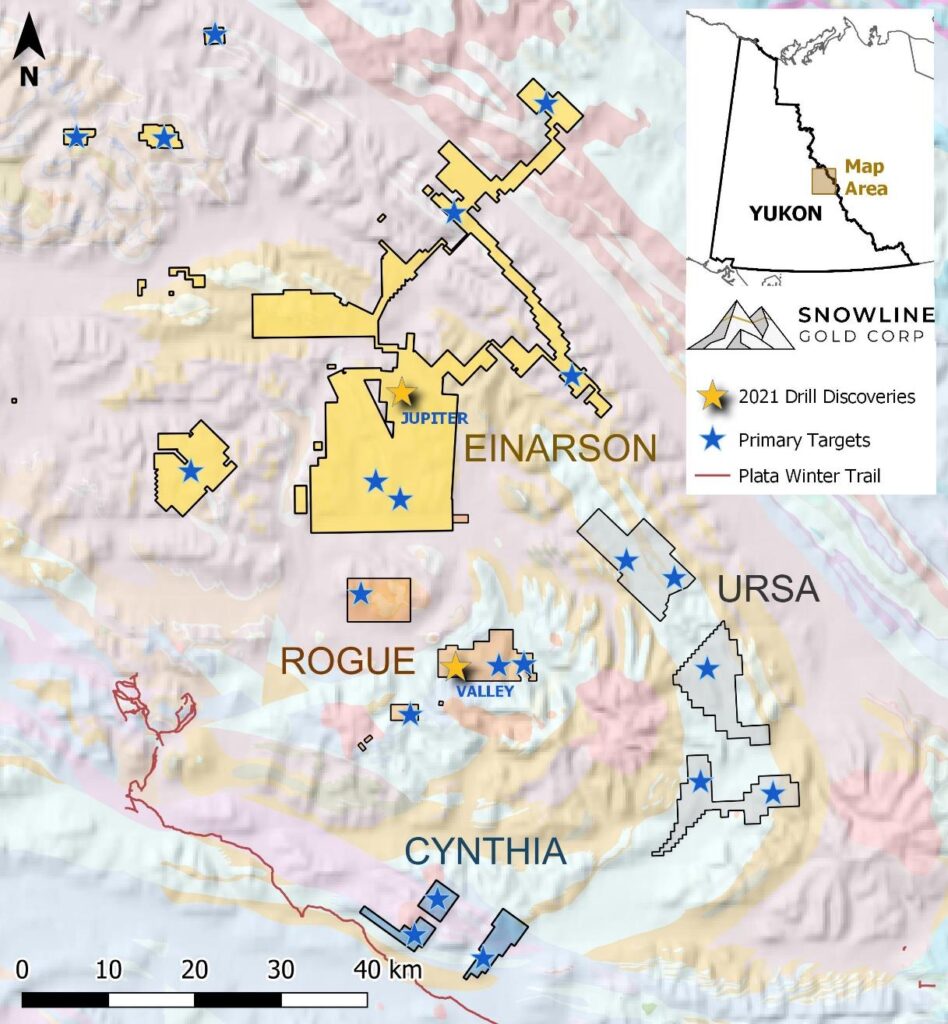

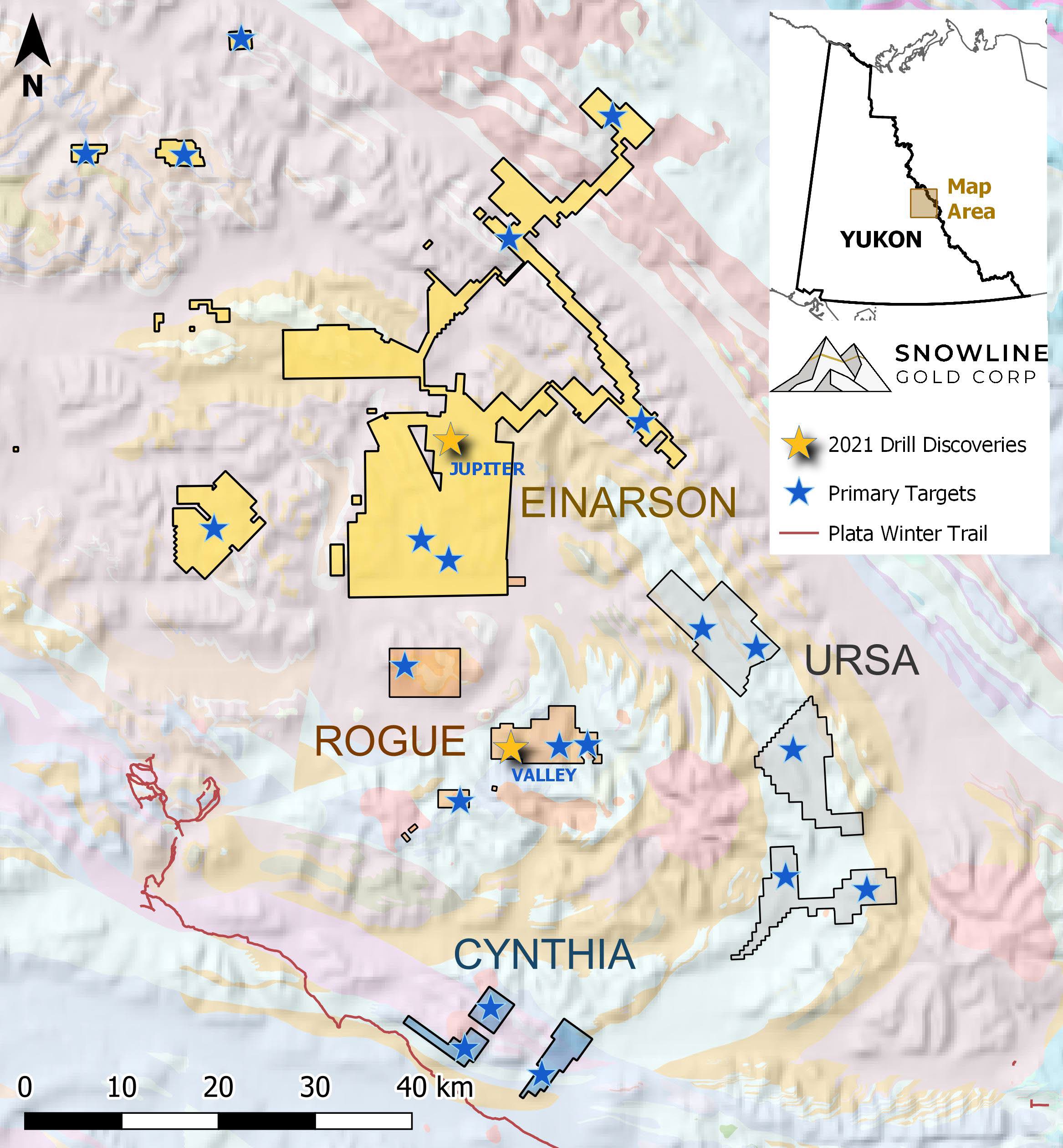

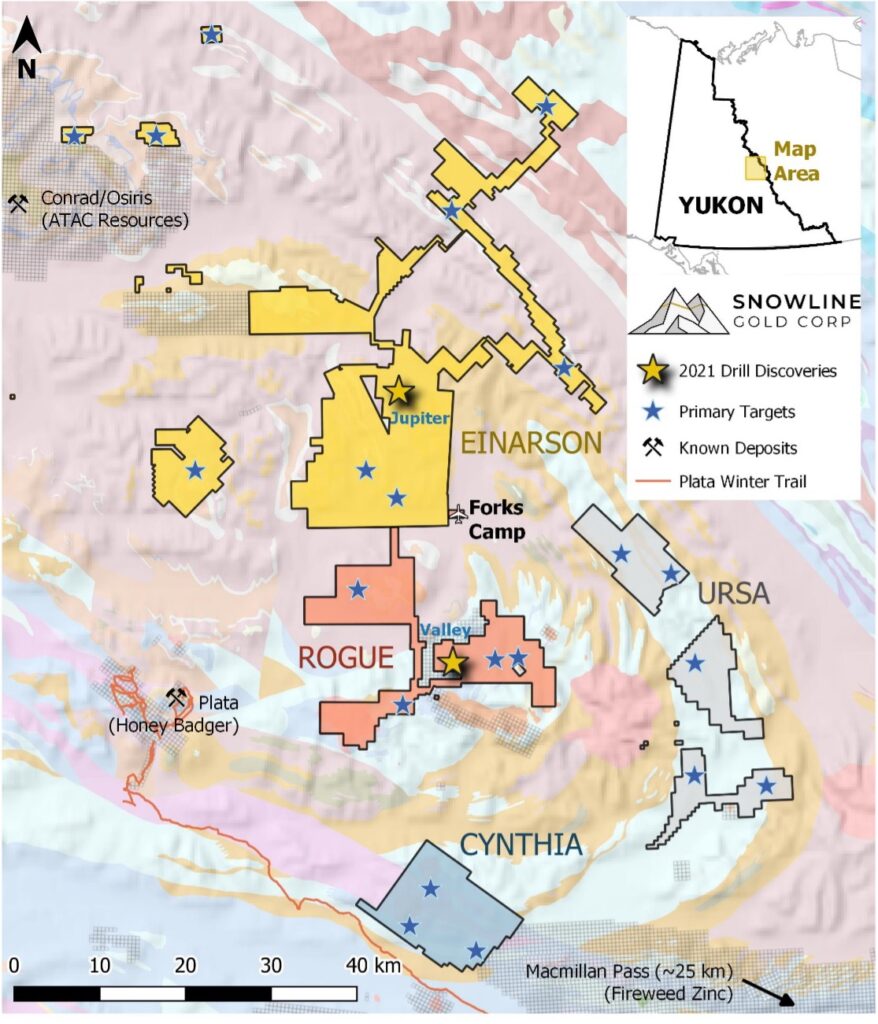

Figure 3 – Updated project location map for Snowline Gold’s eastern Selwyn Basin properties.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seven-project portfolio covering >106,000 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline’s project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross’ Fort Knox mine, Newmont’s Coffee deposit, and Victoria Gold’s Eagle Mine. Snowline’s first-mover land position provides a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

ON BEHALF OF THE BOARD

Scott Berdahl, MSc, MBA, PGeo

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company’s plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.