- Work on fully funded Rogue Project Prefeasibility Study (“PFS”) underway, with extensive supporting fieldwork already completed in 2025

- Wood Canada Limited appointed as lead engineering consultant, responsible for process plant design, infrastructure, capital and operating cost estimation, and overall study integration

- SRK Consulting (Canada) Inc. to lead the geoscience scope, including open-pit mine design and optimization, hydrogeology, water management, geochemistry, and geotechnical studies

- WSP Canada Inc. to lead the tailings storage facility engineering scope, covering trade-off studies and embankment design, facility development, and closure planning

- Expanded environmental baseline program underway to support advanced Rogue Project permitting

Vancouver, B.C., December 16, 2025: SNOWLINE GOLD CORP. (TSX: SGD) (OTCQB: SNWGF) (the “Company” or “Snowline”) is pleased to announce that it has commenced work on a fully funded PFS for the Valley gold deposit (“Valley”) on its flagship Rogue Project in the eastern Yukon Territory. To ensure rigour across different aspects of the study, Snowline has engaged multiple firms on different components of the PFS. Wood Canada Limited (“Wood”) is leading engineering and study integration, SRK Consulting (Canada) (“SRK”) Inc. is leading the geoscience scope, and WSP Canada Inc. (WSP”) is leading tailings storage facility (“TSF”) engineering. The PFS will assess multiple options for possible future development and mine design at Valley, defining the engineering and economic frameworks for advancing Valley towards a potential Feasibility Study. Much of the fieldwork required for the PFS is already complete; during 2025 Snowline conducted comprehensive engineering and environmental programs to inform the PFS, including geotechnical and sonic drilling, infill drilling, metallurgical testing, groundwater hydrology, and geochemical sampling, with supplemental laboratory testing well underway.

“The kick-off of our PFS is an important milestone as we continue to advance our flagship Valley deposit, assessing multiple potential paths forward and optimizing important parameters of a potential future operation,” said Scott Berdahl, CEO & Director of Snowline. “The appointment of committed and experienced teams at Wood, SRK and WSP, each specialized to deliver on different aspects of the PFS, underpins our commitment to deliver a high-quality study that can be used as the basis of future decision making. We look forward to completing this important work and the disclosure of the PFS, a process that we anticipate taking 12 to 15 months to complete.

“I would like to thank our field teams and partners for a safe and successful 2025 field program, accommodating major engineering and environmental work to support the PFS and future permitting efforts while still executing on an ambitious exploration program. These efforts have put us in a strong position to rapidly advance this next level of study. The efficiency with which we have been able to shift from drill discovery to PFS is a testament both to the quality and consistency of the near-surface Valley deposit, and to the efforts and dedication of our team.”

EXTENSIVE ENGINEERING WORK COMPLETED IN 2025

Snowline’s 2025 field program included an expansive engineering program to support rapid progress of a robust PFS. Data collected by this work program is expected to advance and de-risk Valley project design. Completed 2025 engineering work includes:

- 51 sonic drill holes (Figure 1) and 74 excavator test pits to characterize overburden composition and thickness for mine planning and infrastructure site suitability

- Seismic surveying at 146 stations across 6 locations to assess depth to bedrock

- 13 geotechnical holes drilled and logged (assays forthcoming) with testing to characterize rock properties, hydrogeology and pit stability

- Pit geotechnical: Installation of 30 thermistors in two strings and 25 vibrating wire piezometers across seven holes for robust subsurface temperature and groundwater monitoring

- Infrastructure and foundations: Installation of 10 thermistor strings and 40 vibrating wire piezometers for subsurface temperature and groundwater monitoring

- Two additional large diameter metallurgical holes drilled and laboratory work underway to inform flowsheet optimization and power use trade-off studies along with waste rock and tailings characterization

- Dedicated structural geology traverses, drone photogrammetry and drill core structural study to inform and de-risk pit design

- Regional high resolution LiDAR surveying along potential access route corridor

ENVIRONMENTAL BASELINE EXPANDED TO SUPPORT PERMITTING

Snowline initiated environmental surveying during its inaugural 2021 exploration season, completing botanical inventories of key target areas as well as wildlife surveying and monitoring. Hydrology and surface water quality monitoring around the Valley deposit has been ongoing since October 2022.

Following the 2025 PEA, the Company has expanded the breadth and scope of environmental baseline surveying to include potential infrastructure sites and broader regional information. Ongoing environmental baseline surveying includes:

- Significantly increased monthly water quality monitoring sites and continuous monitoring hydrology sites within the Rogue Project area

- Significant expansion of aquatic and fisheries baseline programs (Figure 2)

- Installation of 23 groundwater monitoring wells (Figure 3) for hydrogeology modelling

- Expansion of wildlife surveying to include all species within the Rogue Project area and to capture all seasons across a broad regional footprint

- Installation of a second meteorology site to expand on baseline weather conditions in the Rogue Project area

- Deployment of 6 continuous wind monitoring stations to evaluate the potential for wind energy generation for the Rogue Project

The expanded environmental baseline program informs preparation for future Environmental Assessment and permitting of the Rogue Project, with collaborative discussions underway with First Nations on ongoing environmental baseline activities and surveys.

WOOD CANADA LIMITED – LEAD ENGINEERING

Wood will serve as the lead engineering company for the PFS. Its mandate includes process plant and site infrastructure design, integration of logistics and power systems, and preparation of capital and operating cost estimates. Wood brings extensive experience in delivering complex mining and infrastructure projects in remote northern climates, with strong expertise in cold-weather construction, permafrost engineering, and logistics planning. Wood will also oversee the coordination of all study deliverables and maintain schedule and cost alignment across disciplines.

SRK CONSULTING (CANADA) INC. – GEOSCIENCE & MINE ENGINEERING

SRK will lead the geoscience scope of the PFS. This includes open-pit mine design and optimization, geotechnical and hydrogeological characterization, water management, geochemistry, closure planning and related support studies. SRK’s team combines deep technical expertise across mining, engineering and environmental disciplines with direct familiarity with the Valley deposit. SRK have supported the Rogue Project through completion of the PEA and an extensive field program in 2025. Their involvement provides valuable continuity of knowledge and ensures a high level of technical integration across the PFS components.

WSP CANADA INC. – TAILINGS STORAGE FACILITY DESIGN

WSP has been selected to lead the TSF engineering scope. The company will be responsible for the design of the TSF including tradeoff studies, embankment design, facility development, and closure planning. WSP’s Canadian team brings strong technical capabilities in tailings design, water management, and closure planning. Their work will ensure that the TSF meets both best-practice engineering standards and internationally recognized guidelines for tailings management, emphasizing long-term environmental performance and sustainability.

ABOUT SNOWLINE GOLD CORP.

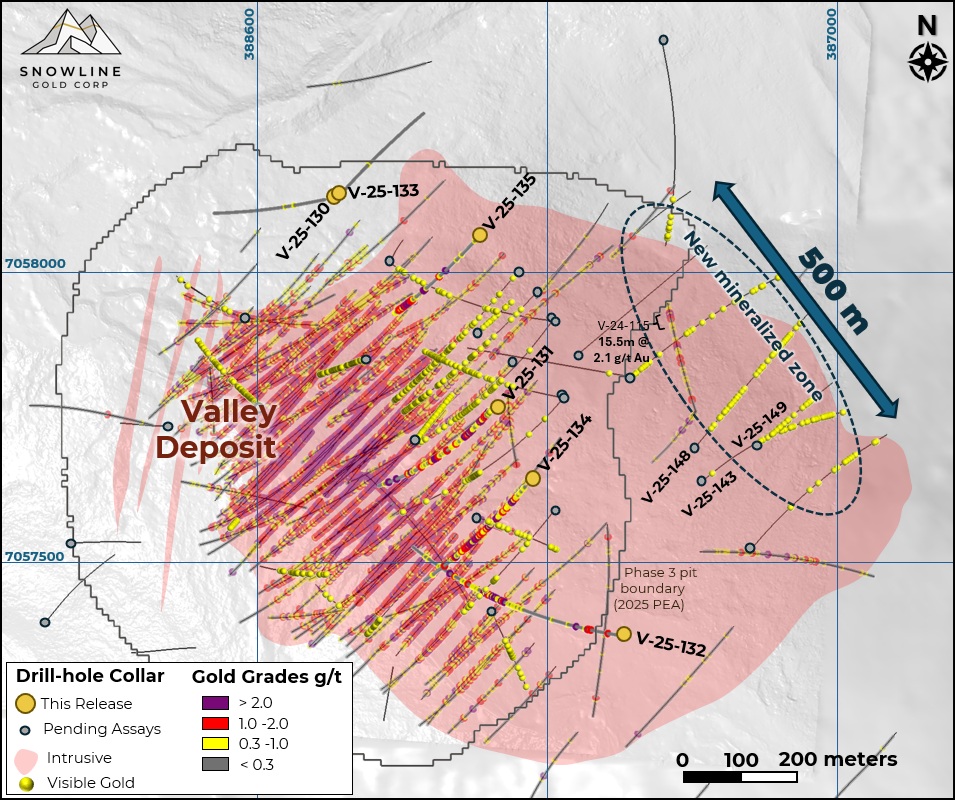

Snowline Gold Corp. is a Yukon Territory focused gold exploration and development company with mineral claim portfolio covering roughly 360,000 ha (3,600 km2). The Company is focused on advancing its Valley gold deposit—a large, low-strip, near surface, >1 g/t Au bulk tonnage gold system located in the eastern Yukon—while continuing regional exploration of surrounding targets on the Rogue Project and the broader district in the highly prospective yet underexplored Selwyn Basin.

Valley hosts an open MRE of 7.94 million ounces gold at 1.21 g/t Au in Measured & Indicated categories (in 204.0 million tonnes) and an additional 0.89 million ounces gold at 0.62 g/t Au in the Inferred category (in 44.5 million tonnes)[1], with a cut-off grade of 0.3 g/t Au. Results of the Valley PEA suggest the potential for the deposit to support a long-life mining operation with a strong production profile and low production costs. The MRE and PEA are supported by the recent Technical Report, prepared in accordance with National Instrument 43-101- Standards of Disclosure for Mineral Projects (“NI 43-101”) standards, available on SEDAR+ and the Company’s website.

Snowline’s project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits across the central Yukon and Alaska. The Company’s comprehensive first-mover position and extensive exploration database provide a distinct competitive advantage and a unique opportunity for investors to be part of multiple discoveries, the advancement of a significant gold deposit, and the creation of a new gold district.

QUALIFIED PERSON

Information in this news release in all sections apart from the “About Snowline Gold Corp.” section has been prepared under the supervision of and approved by Victor Vdovin, M.Sc., MBA, P. Eng., Vice President of Engineering for Snowline, as Qualified Person for the purposes of NI 43-101.

Information in the “About Snowline Gold Corp.” section of this news release has been prepared under the supervision of and approved by Sergio Gamonal, M.Sc., P.Geo., Chief Geologist for Snowline, as Qualified Person for the purposes of NI 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company’s work programs, results, including of ongoing assay testing, surface work, advancement of studies and permitting, the completion of supplemental laboratory testing, the ability of the TSF engineering to meet best-practice engineering standards and internationally recognized guidelines for tailings management, the completion and timing of a potential PFS and other studies, potential styles of mineralization, expansion and upgrading of MRE, projected mining plans, continued exploration, expansion of the mineralization system at Valley and the creation of a new gold district. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “target”, “intend”, “ensure”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; risks related to the timing and completion of the PFS; and risks associated with executing the Company’s plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

[1]Mineral resources are not mineral reserves and do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by metal prices, economic factors, environmental, permitting, legal, title, or other relevant issues.