- Hole V-23-036 returned 2.92 g/t Au over 143.5 m within broader mineralized interval averaging 1.53 g/t Au over 414.5 m from surface, extending near-surface, multiple-gram-per-tonne corridor on the Rogue Project’s Valley discovery by 75 m to the southeast

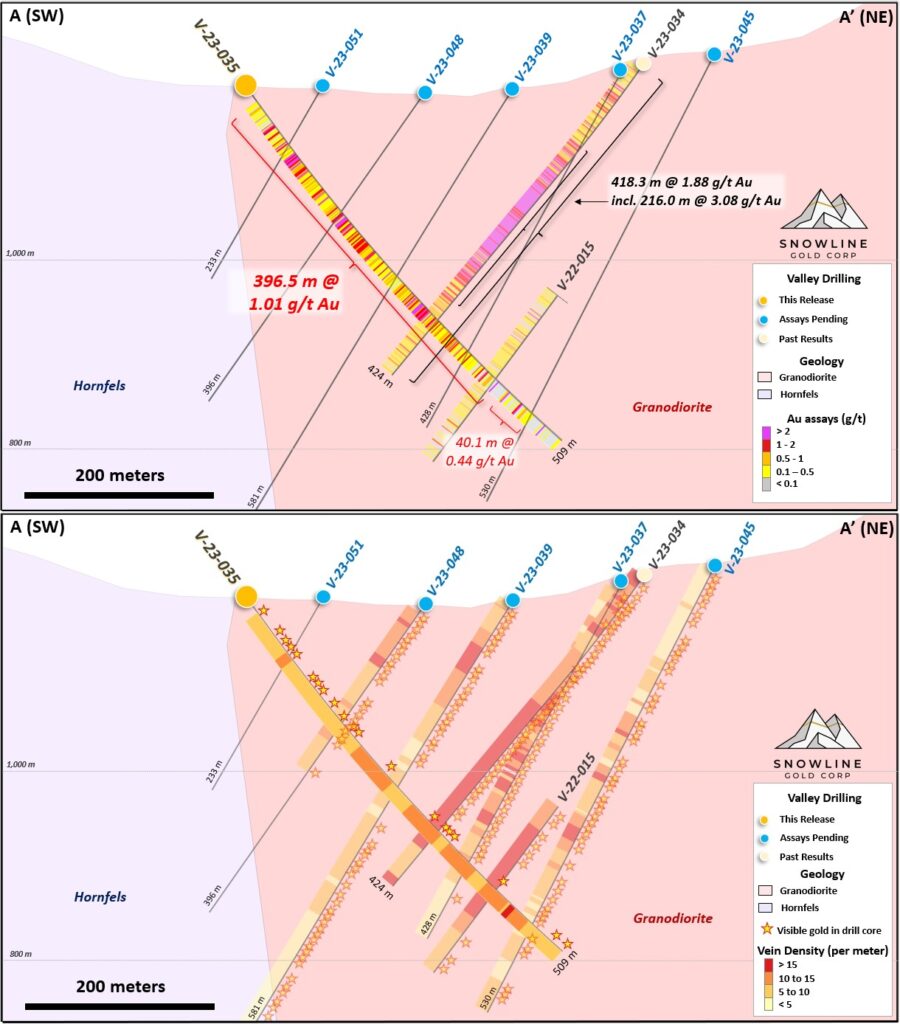

- Hole V-23-035 returned 1.01 g/t Au over 396.5 m from surface, demonstrating robust near-surface mineralization to western margin of Valley intrusion

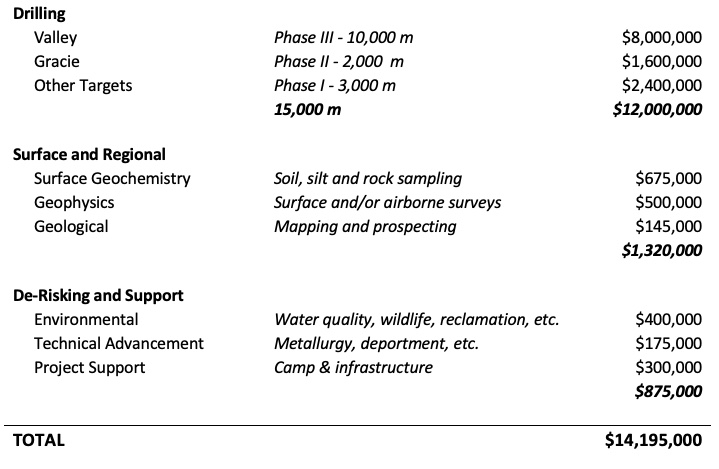

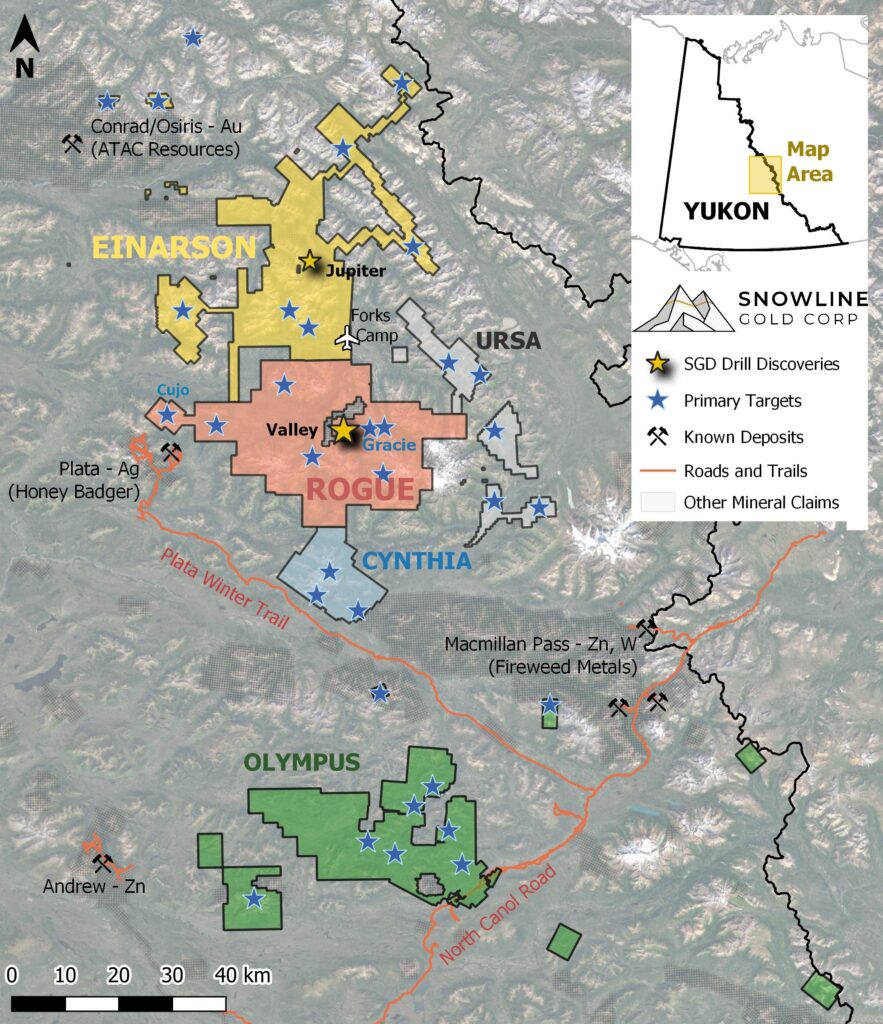

- Phase II drilling underway at the Rogue Project’s Gracie target, a potential intact Valley-style gold system located in between the gold-bearing Valley and Reid targets

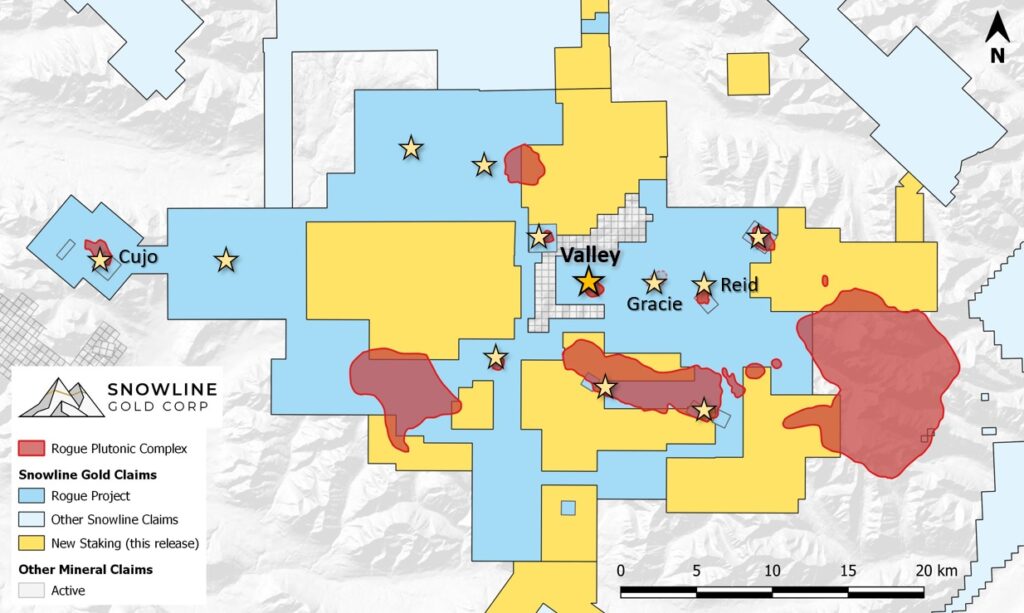

- Multiple generations of sheeted quartz veins along with bismuthinite identified within an exposed intrusion on recently consolidated Cujo target within the Rogue Plutonic Complex.

Vancouver, B.C., July 18, 2023: SNOWLINE GOLD CORP. (TSX-V: SGD) (OTC: SNWGF) (the “Company” or “Snowline”) is pleased to announce analytical results from the second and third holes of its 2023 drilling program at the Valley target on its Rogue Project in Canada’s Yukon Territory. Hole V-23-036, drilled to test the southeast edge of Valley’s near-surface corridor of multiple-gram-per-tonne gold mineralization, succeeded in expanding its known extent roughly 75 m farther to the southeast. The hole averaged 2.92 g/t Au over 143.5 m from 23.5 m downhole, within a broader interval of 1.53 g/t Au over 414.5 m from bedrock surface. In addition, hole V-23-035 expanded known mineralization to the western edge of the Valley intrusion, returning 1.01 g/t Au over 396.5 m from bedrock surface. Analytical results for all 17 holes (6,650 m) beyond V-23-036 at Valley are pending, with drilling at Valley ongoing.

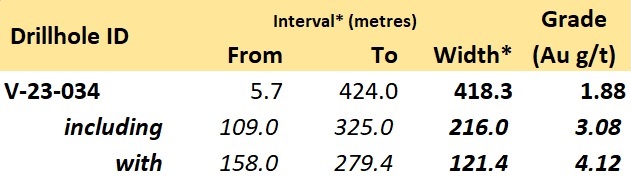

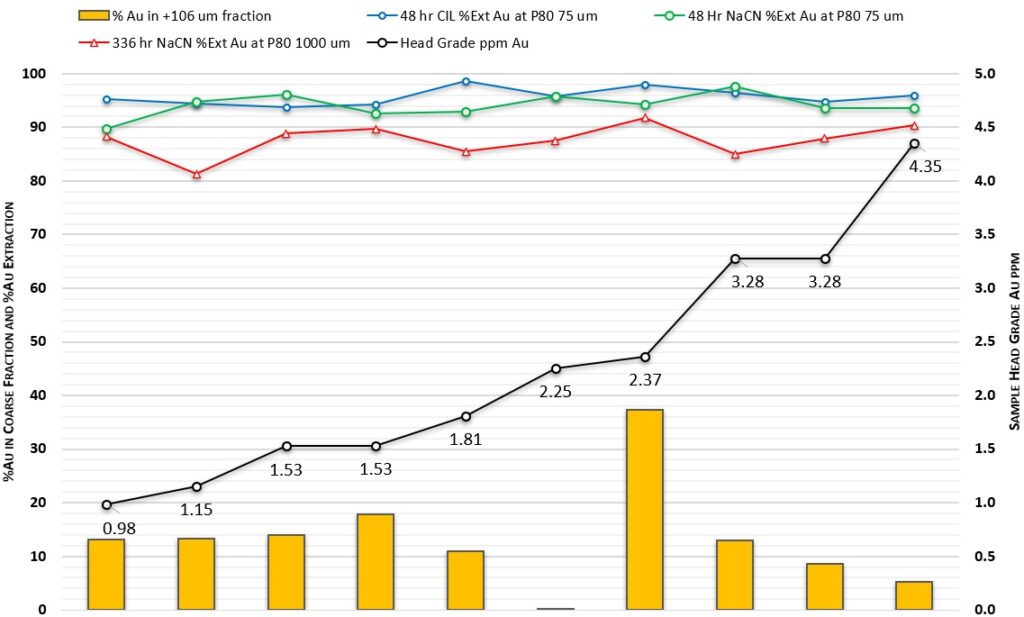

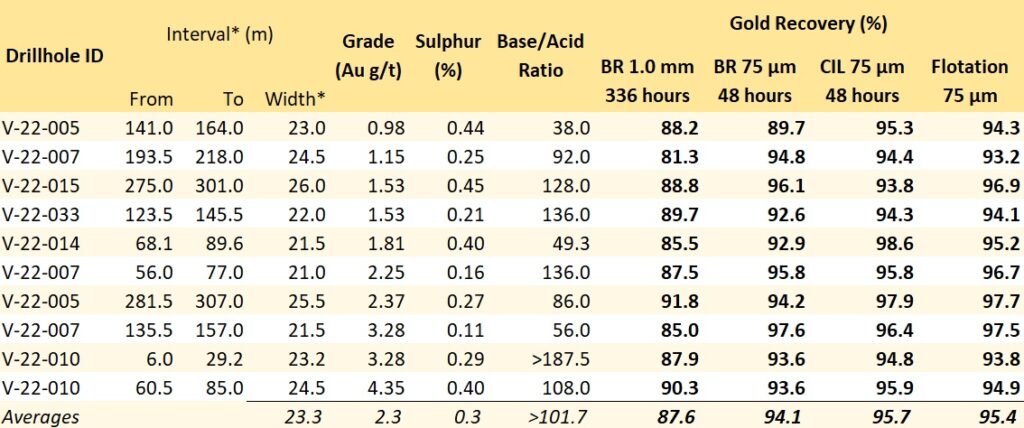

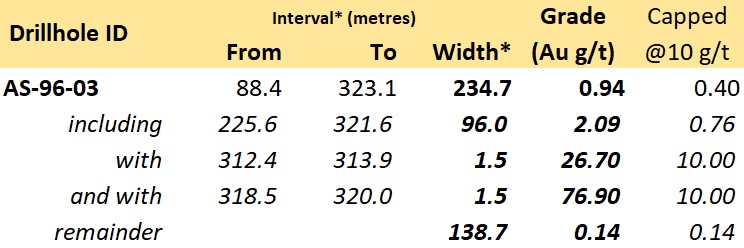

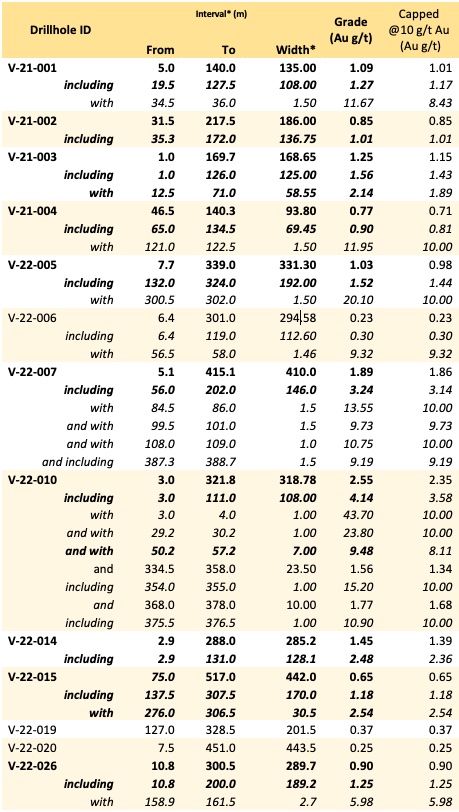

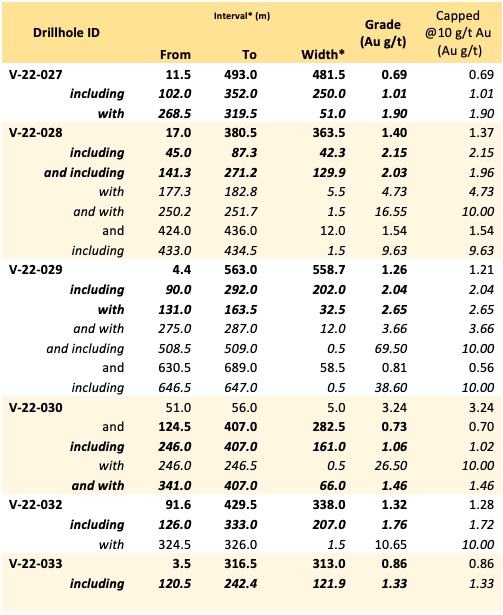

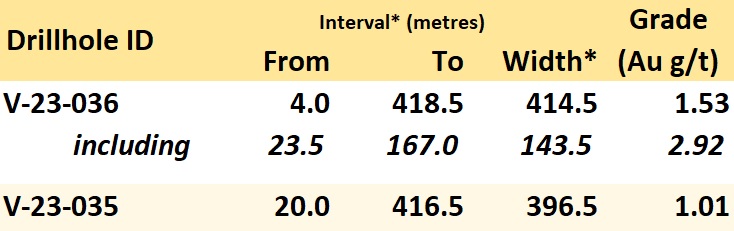

Table 1 – Highlight summary of Snowline’s latest assay results. *Interval widths reported; true widths of the system are not yet known.

“Today’s results highlight the significant exploration upside present within the broader footprint of last season’s widely spaced, first-pass drilling of the Rogue Project’s Valley target,” said Scott Berdahl, CEO & Director of Snowline. “This is particularly true when it comes to Valley’s extensive zone of near-surface, multiple-gram-per-tonne gold mineralization. The gold grades and continuity in V-23-036 add a large tonnage of potentially high-value rock to this zone, which remains open further to the southeast. In addition, the breadth of the mineralized interval in V-23-035, drilled from the western margin of the intrusion, highlights the breadth of strong mineralization present outside of the highest-grade core at Valley, both laterally and to depth. This has strong favorable implications for a favourable strip ratio, low internal dilution, and of course overall gold content in any potential future operation at Valley. With our exploration season still ramping up, we are encouraged by these early results, and we look forward to additional results from Valley as well as from additional targets.”

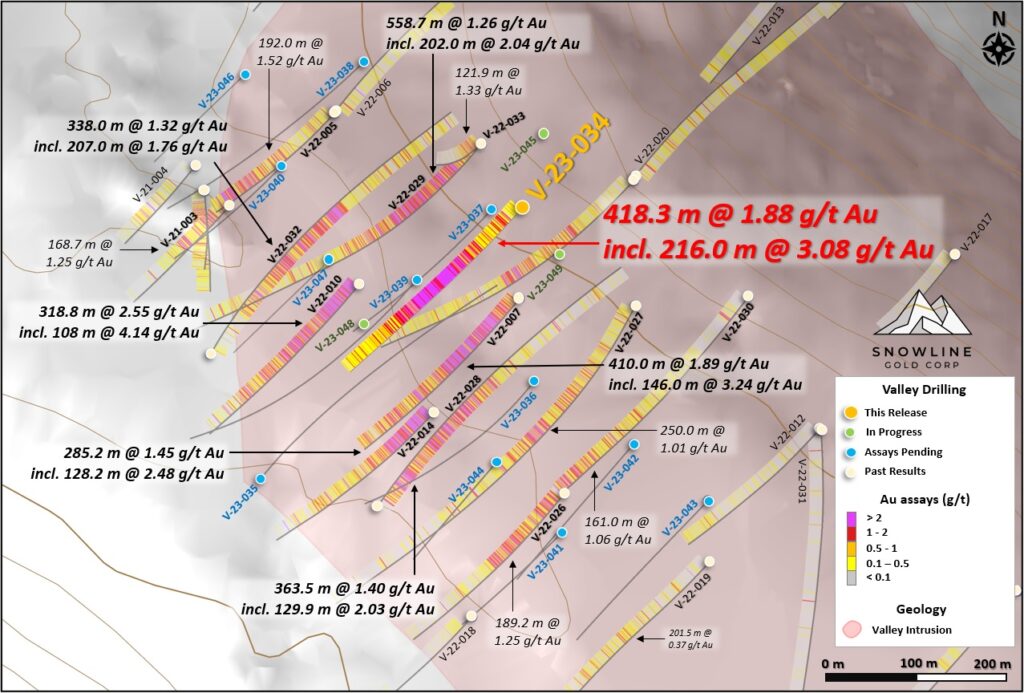

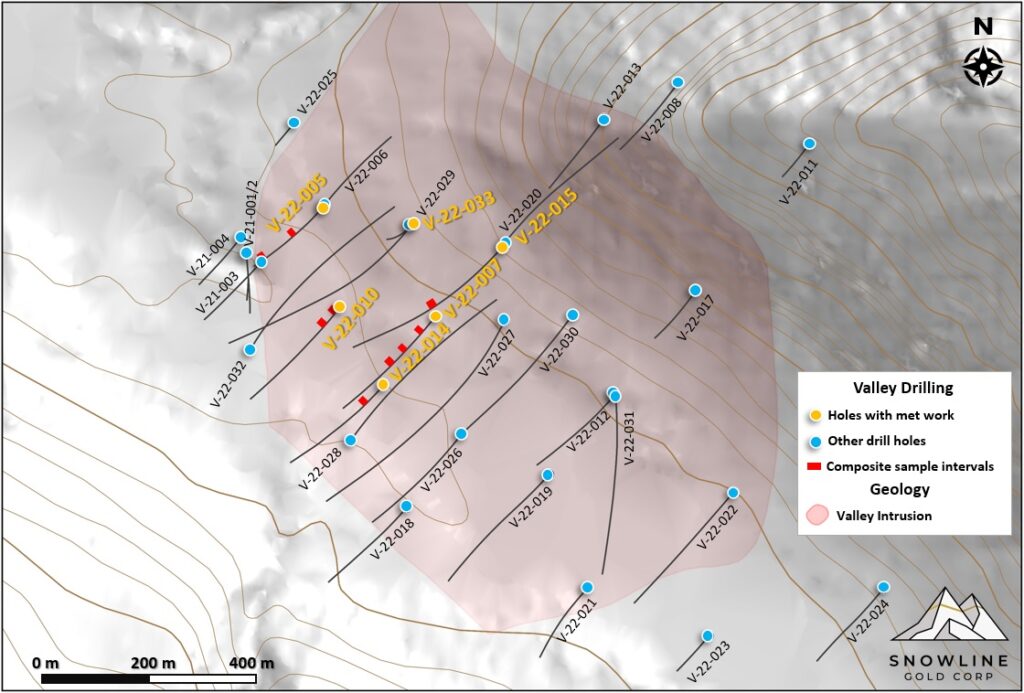

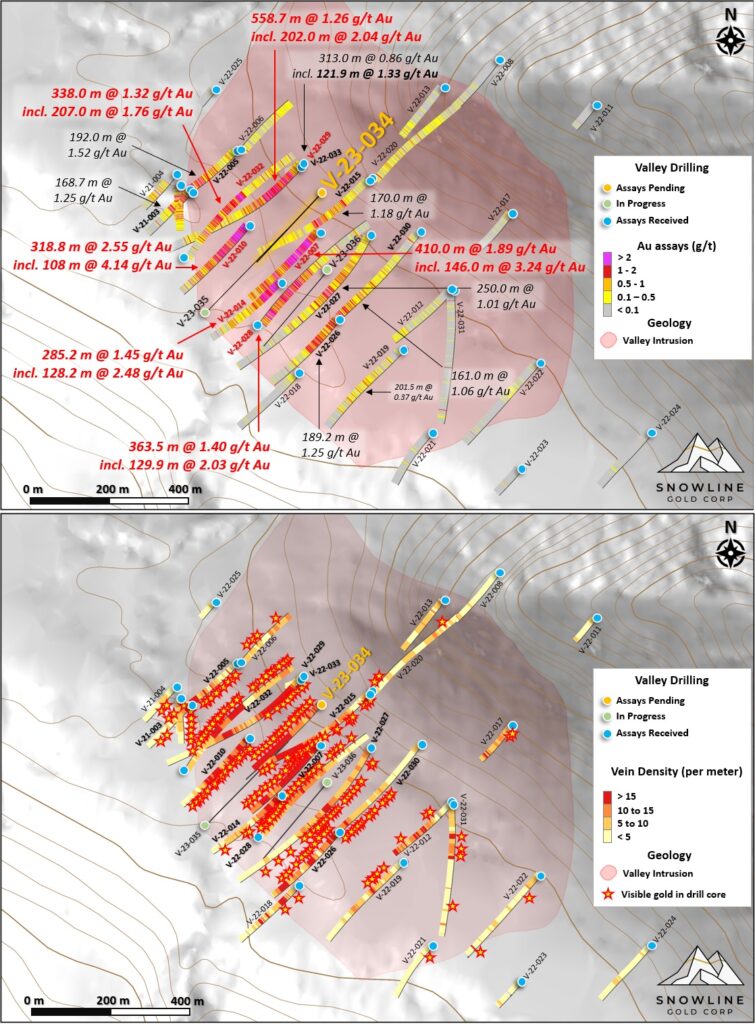

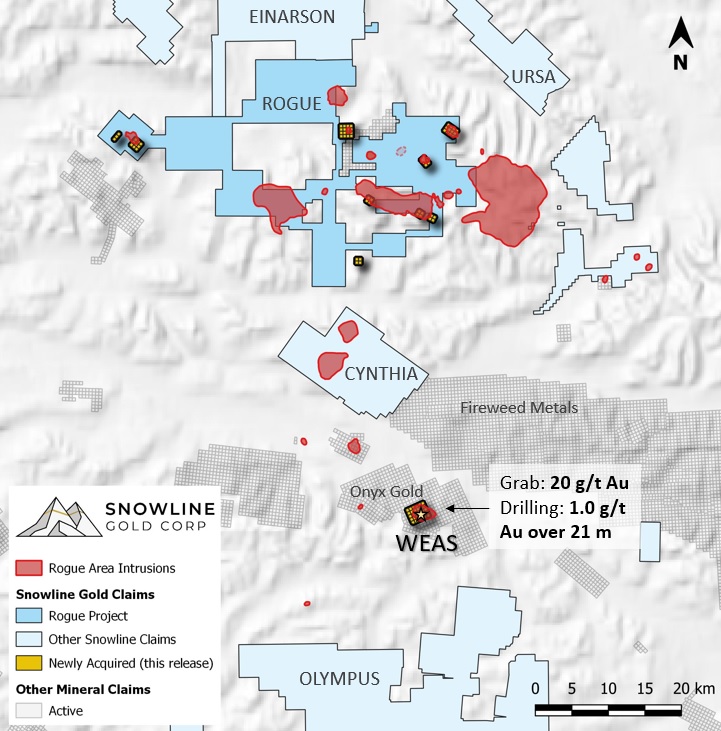

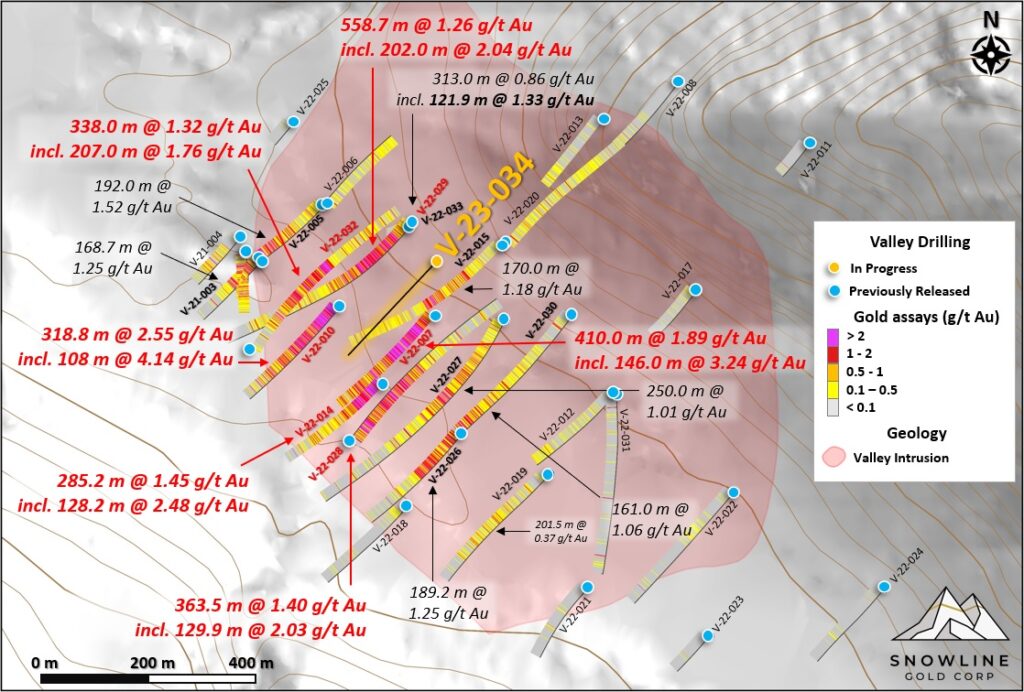

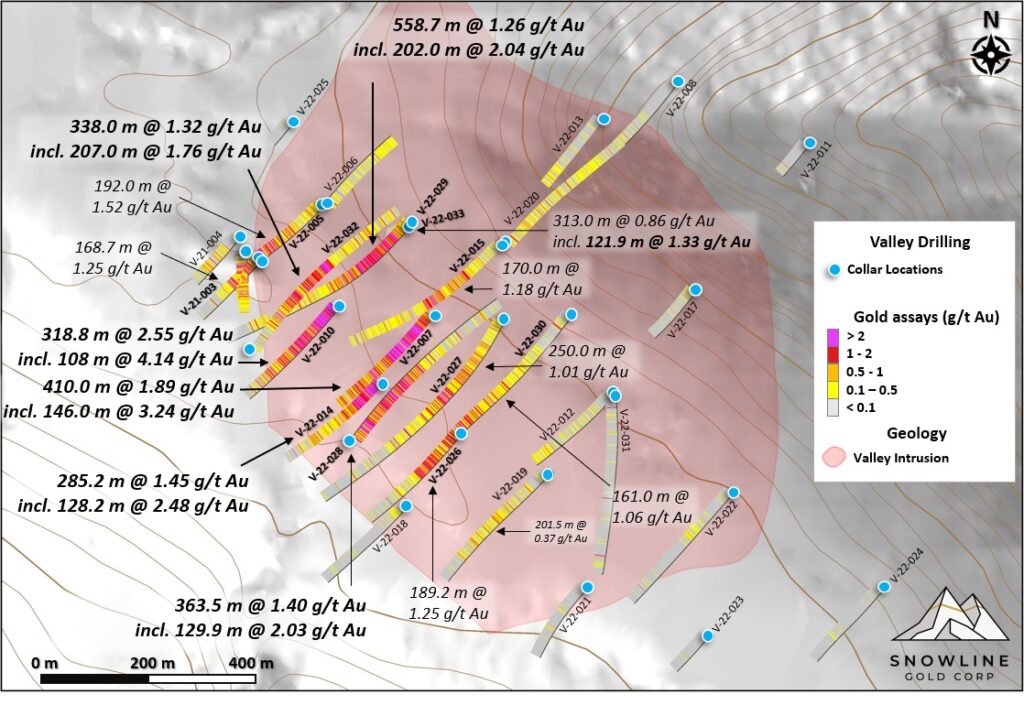

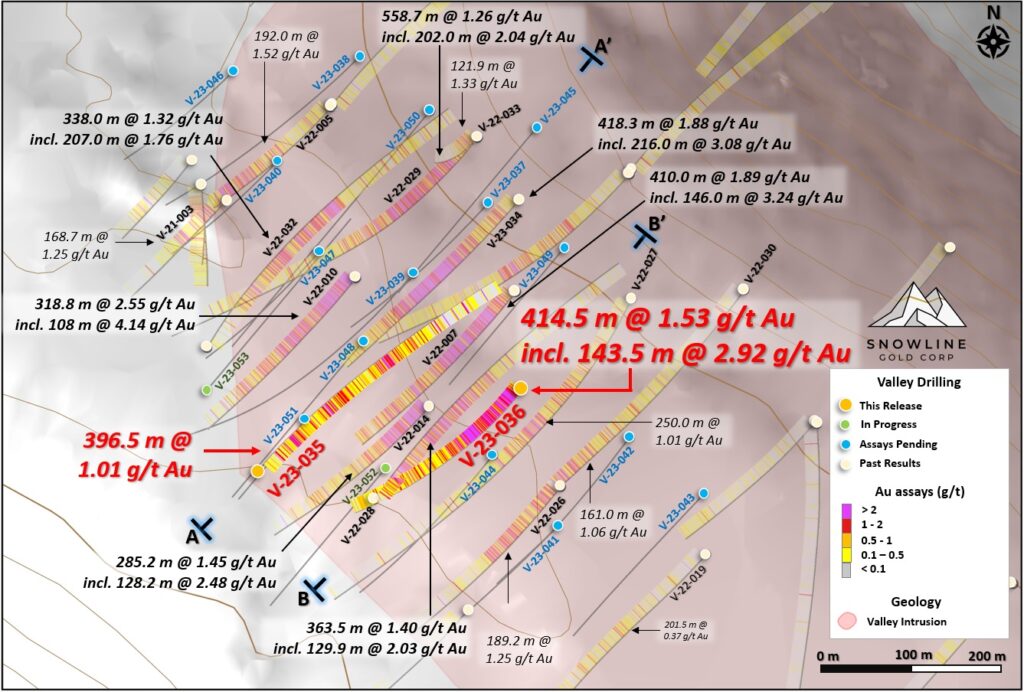

Figure 1 – Plan view of the Rogue Project’s Valley target showing analytical results from previous and current drilling, along with approximate traces of current holes. The higher grades encountered at the top of V-23-036 extend the broad, NW-SE corridor of near-surface, multiple-gram-per-tonne gold mineralization by roughly 75 m to the southeast of the section containing V-22-014 and V-22-007. Hole V-23-035 extends the known limit of mineralization to the southwest, and demonstrates strong, continuous gold mineralization along the margin of the higher-grade zone. Given the overhead perspective, the bottom of V-23-035 appears to interrupt higher-grade mineralization seen in V-23-007 and V-23-034, but these results are several hundred metres below the mineralization in these holes. Better context is given by Figure 3, showing section A-A’.

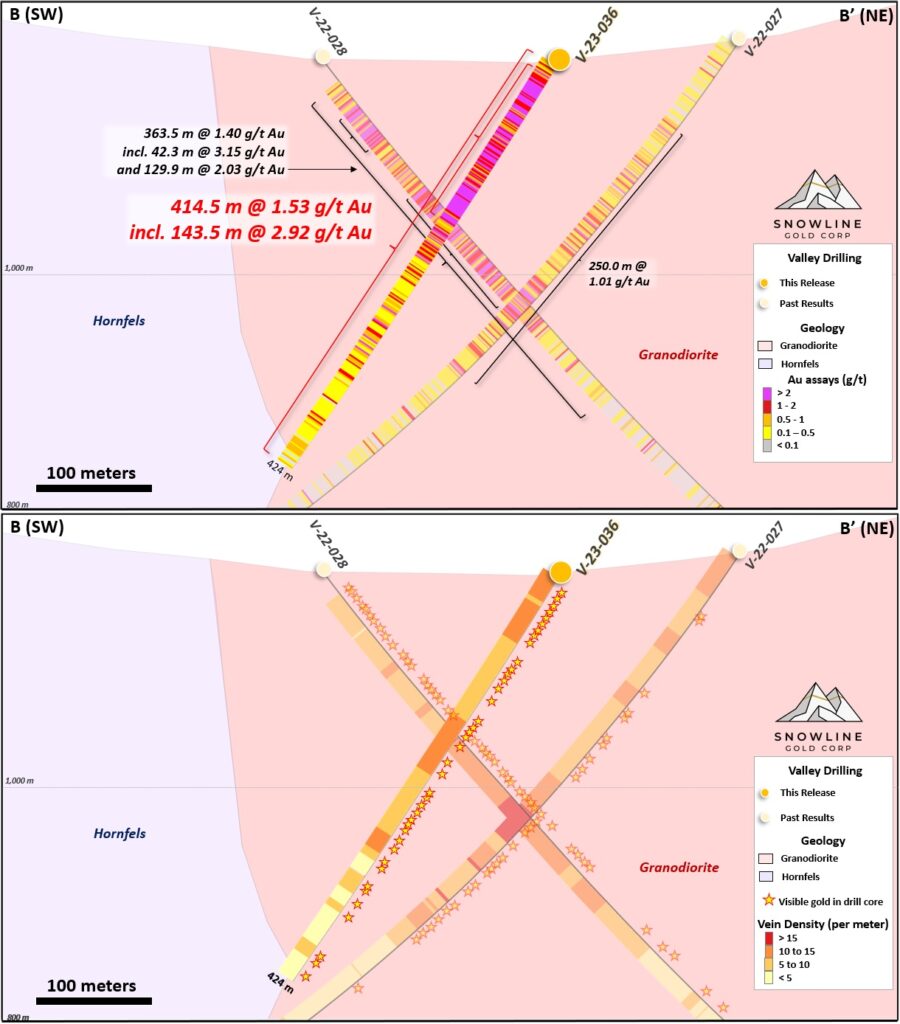

Figure 2 – Cross-section B, showing results received (top) and vein densities alongside instances of visible gold observed during logging (bottom). Note that V-22-027 is in the foreground of the section, while V-22-028 is in the background.

HOLE V-23-036

Hole V-23-036 is collared within the Valley intrusion, along strike with and now recognized as part of the extensive, near-surface, >2 g/t Au corridor discovered at Valley in 2022. The hole is a 75 m step-out along strike from the mineralization encountered in V-22-007 (410.0 m @ 1.89 g/t Au from surface including 146.0 m @ 3.24 g/t Au, see Snowline news release dated November 15, 2022) and V-22-014 (285.2 m @ 1.45 g/t Au including 128.2 m @ 2.48 g/t Au from surface, same news release). Previous drilling in the vicinity of the collar site only tested the system at depth, where holes V-22-027 and V-22-028 returned long intervals of relatively consistent gold mineralization (Figure 1).

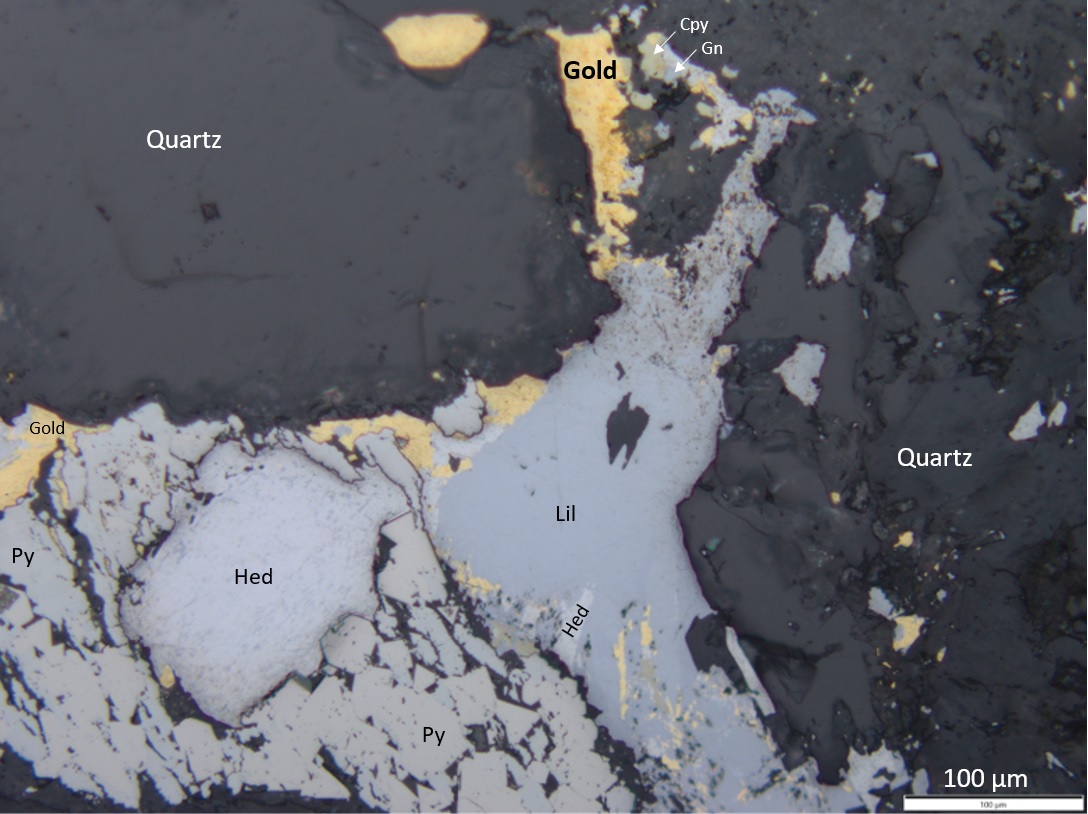

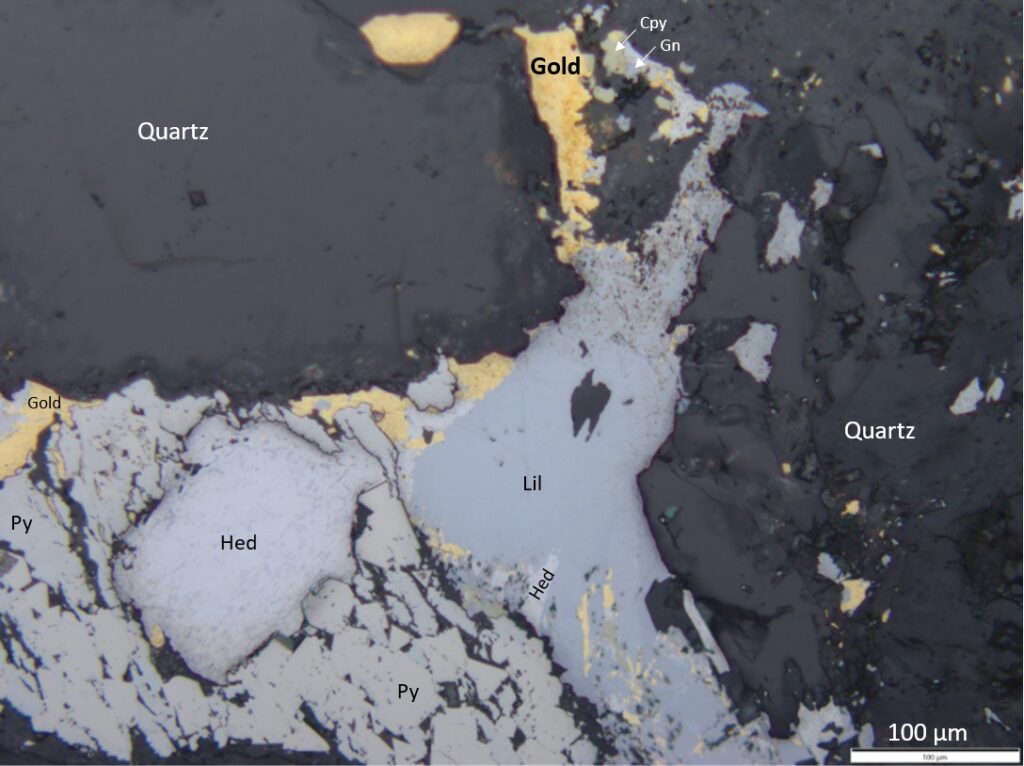

The hole intersected abundant sheeted quartz veins in granodiorite, with multiple generations of gold-bearing quartz veins observed. The entire hole is mineralized, returning 1.53 g/t Au over 414.5 m from bedrock surface at approximately 4.0 m downhole depth, including a higher-grade interval of 2.92 g/t Au over 143.5 m from 23.5 m downhole. The hole exits the intrusion at 407.6 m downhole. It ends in low to moderate gold mineralization, with the final 20.0 m averaging 0.43 g/t Au.

Within the 143.5 m interval at 2.92 g/t Au, 131 of 148 samples assayed higher than 1.0 g/t Au—representing 127.5 m (non-contiguous) or 89% of the downhole interval. Only a single assay within this interval—1 m downhole distance—returned a value <0.5 g/t Au at 0.49 g/t Au. While high grades of up to 20.70 g/t Au are present, they are not primary drivers of the broader mineralized intervals. Applying a cap at 10 g/t Au reduces the average grade of the 414.5 m hole by just 1.9% from 1.53 g/t Au to 1.50 g/t Au, with a similarly subtle effect on sub-intervals (Table 2). Results from V-23-036 expand the known extent of near surface, >2 g/t Au mineralization at Valley and further demonstrate strong continuity of mineralization at Valley.

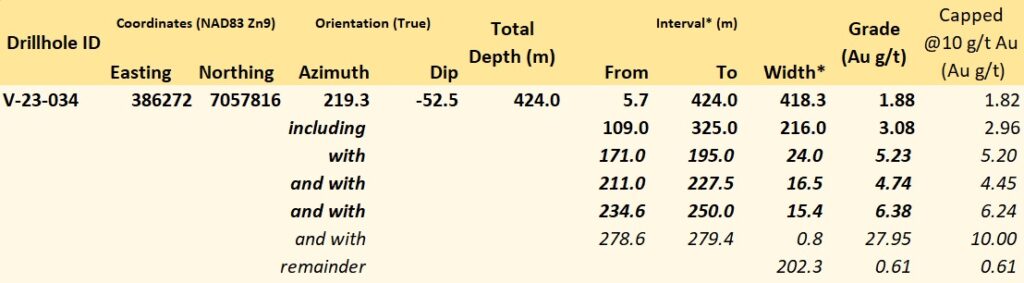

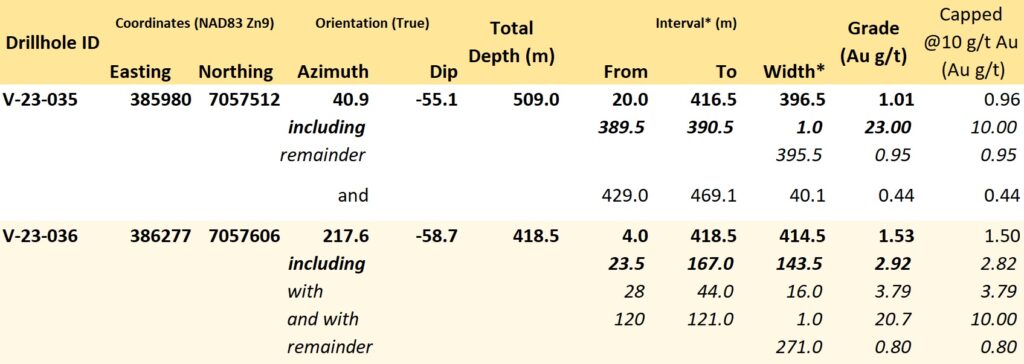

Table 2 – Summary of mineralization observed in current holes. The consistency of strong mineralization is reinforced by the capped values in the rightmost column, wherein any assay result >10 g/t Au is replaced by 10.0 g/t Au to calculate the average interval grades. The high results demonstrate uniform gold mineralization that is not “smeared” across a given interval by isolated high-grade samples. *Interval widths reported; true widths of the system are not yet known, with different vein generations, orientations and grade distributions present within various intervals through the bulk tonnage gold target at Valley.

Figure 3 – Cross-section A, showing results received (top) and vein densities alongside instances of visible gold observed during logging (bottom).

HOLE V-23-035

Hole V-23-035 is collared near the southwestern boundary of the Valley intrusion, over 130 m from the nearest previous hole (V-22-028; 363.5 m @ 1.40 g/t Au) and collared farther to the southwest than any other hole at Valley to date. Drilled towards the northeast, it tests near-surface mineralization near the southwest edge of the intrusion and mineralization at depth beneath Valley’s well-mineralized near-surface corridor.

The 509.0 m hole is entirely within granodiorite of the Valley intrusion, with dominantly moderate quartz vein densities throughout. It returned a consistent initial intersection of 396.5 m averaging 1.01 g/t Au from bedrock surface at 20.0 m downhole. Below this, from 429.0 m downhole, a separate mineralized interval averaged 0.44 g/t Au over 40.1 m. The hole ended in weak, intermittent mineralization, with the final 3.5 m averaging 0.23 g/t Au.

Such robust, >1 g/t Au, gold grades encountered in V-23-035 along the southwest margin of the known mineralized system provide strong support for the idea of a single, large, recoverable body of gold mineralization at Valley with a very low strip ratio and minimal internal dilution.

EXPLORATION UPDATE

Valley Target Drilling, Rogue Project

The 10,000+ m drill program at the Rogue Project’s Valley discovery is ongoing, with two drill rigs active on site. To date, >8,000 m has been drilled on the Valley target in 2023, with 18 holes completed, an additional 2 holes in progress, and significant additional drilling planned. Analytical results for all but 3 holes drilled at Valley in 2023 are pending.

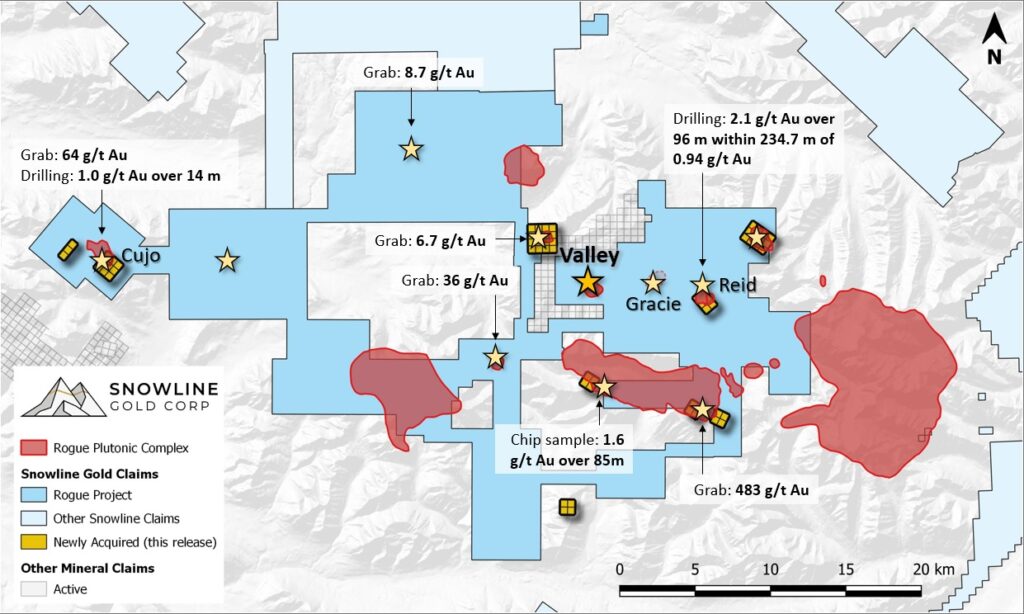

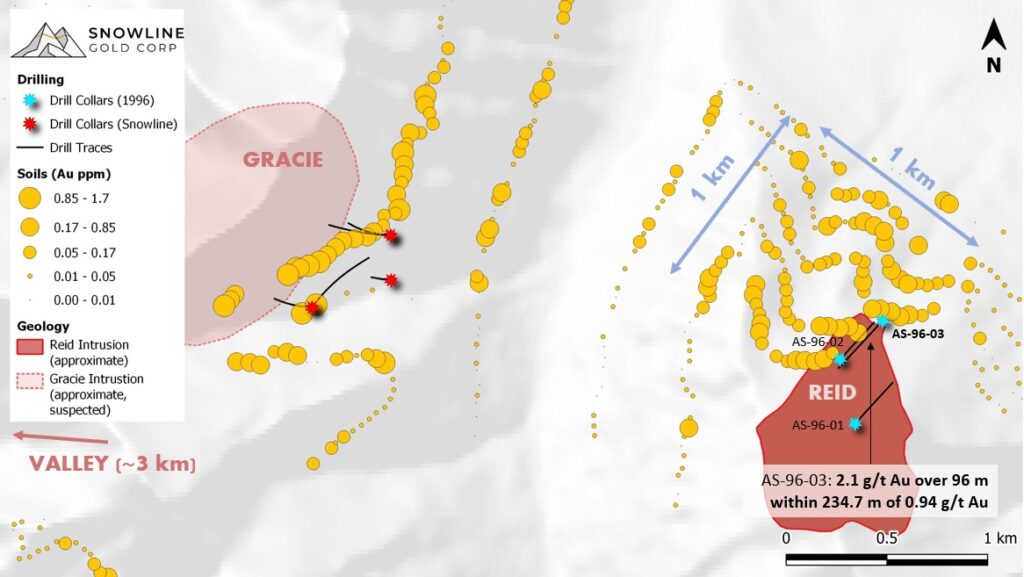

Gracie Target Drilling, Rogue Project

A 2,000+ m diamond drill program is underway at Gracie, with the commencement of drilling on G-23-006. The Phase II program will begin with 4 drill holes, building on the results of 2022 Phase I drilling. The 2022 program confirmed the presence of a reduced intrusion-related gold system (RIRGS) along with gold-bismuth-tellurium mineralized quartz veins oriented parallel to the dominant mineralized vein set at the Valley target. It also provided a potential vector towards the heat source; the current program will test for the presence of an intrusion to the northwest of the 2022 drill holes.

Gracie is an unexposed RIRGS target. Unlike the RIRGS at the Valley target, which is partially eroded, a mineralized system at Gracie would be completely intact, presenting an attractive exploration target roughly 4 km from the edge of the Valley intrusion to its west, and a similar distance from the gold-bearing Reid intrusion to its east.

Cujo Target, Rogue Project

Surface work at the Rogue Project’s recently consolidated Cujo target (Figure 5) identified multiple generations of sheeted quartz veins within an exposed intrusion of the Rogue Plutonic Complex. Instances of bismuthinite and associated bismuth and tellurium minerals, which are strongly correlated to gold mineralization at the Valley target, are present in the veins.

Figure 4 – Intrusive host and veining style at Valley (left) and Cujo (right). Coarse grained granodiorite with fine-grained biotite rich xenoliths (outlined by white dashed lines). Sericite-chlorite alteration and quartz-calcite-bismuthinite-scheelite veins. A) Core samples from hole V-23-036 at the Valley target, 5 to 8 meters depth. B) Surface sample from the Cujo target.

A recent grab sample of float material from hornfels northwest of the Cujo intrusion returned 63.8 g/t Au, while grab samples of quartz vein material from within the intrusion assay from <50 ppb Au to 12.8 g/t Au. Limited historical drilling of the target conducted in 1996 returned an intersection of 1.02 g/t Au over 13.6 m. These results have not been verified by the company, but historical pad sites have been relocated by field crews.

Cliff Project Drilling

Outside of Rogue, a Phase I drill program using a fourth drill is underway at the Company’s Cliff Project in the southwest Yukon. Cliff covers a series of previously untested orogenic gold targets in the vicinity of a prolific placer district that has seen continuous placer gold production from various creeks for more than a century. No obvious source to this mineralization has been located to date.

QA/QC

On receipt from the drill site, Valley’s NQ2-sized drill core was systematically logged for geological attributes, photographed and sampled at Snowline’s 2023 field camp. Sample lengths as small as 0.5 m were used to isolate features of interest, but most samples within moderate to strong mineralization were 1.0 m in length; otherwise, a default 1.5 m downhole sample length was used. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently) collected for analysis and one half stored as a record. Field duplicates were collected at regular intervals as ¼ core samples by splitting the ½ core sent for sampling, leaving a consistent record of half core material from duplicate and non-duplicate samples alike. Standard reference materials and blanks were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor to Bureau Veritas’ preparatory facility in Whitehorse, Yukon. Sample preparation was completed in Whitehorse, with analyses completed in Vancouver.

Bureau Veritas is accredited to ISO/IEC 17025 and ISO9001 for quality management. Samples were crushed by BV to >85% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. A four-acid digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 59-element analysis on 0.25 g sample pulps (BV code: MA250). All samples were analysed for gold content by fire assay with an atomic absorption spectroscopy (AAS) finish on 30 g samples (BV code: FA430). Any sample returning >10 g/t Au was reanalysed by fire assay with a gravimetric finish on a 30 g sample (BV code: FA530).

All standard reference materials and blanks inserted into the sample streams for the two holes returned values within acceptable limits.

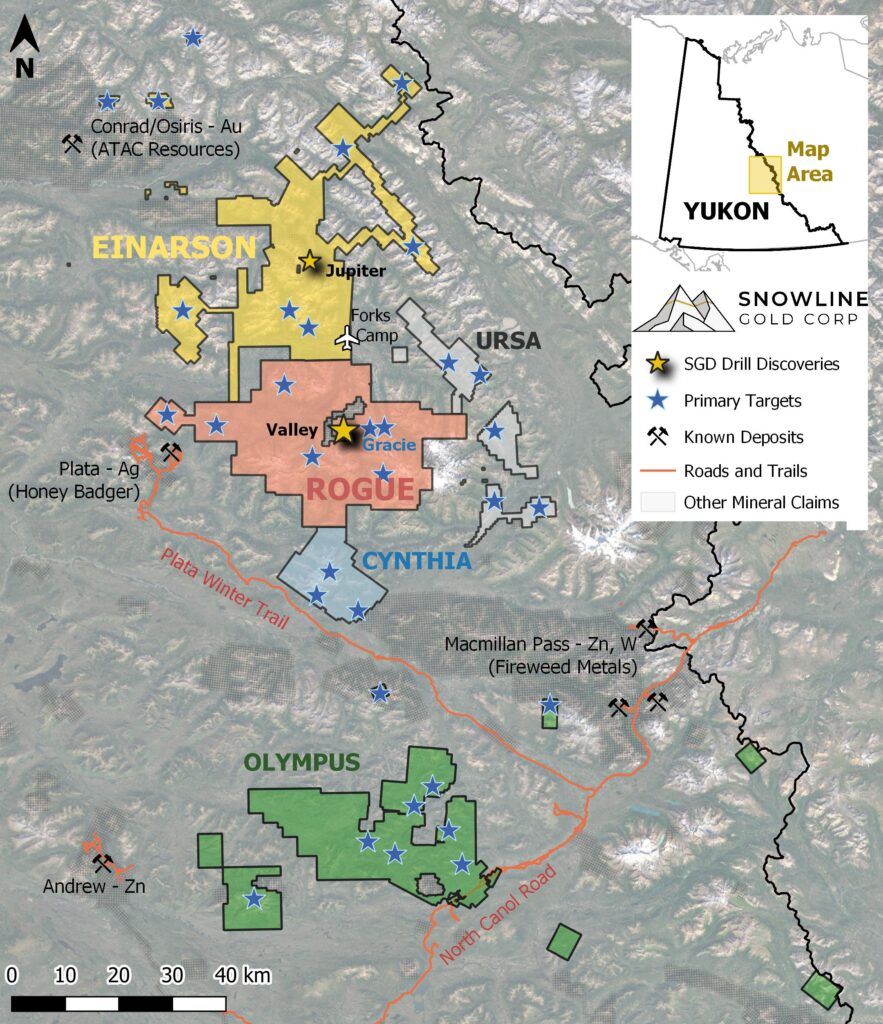

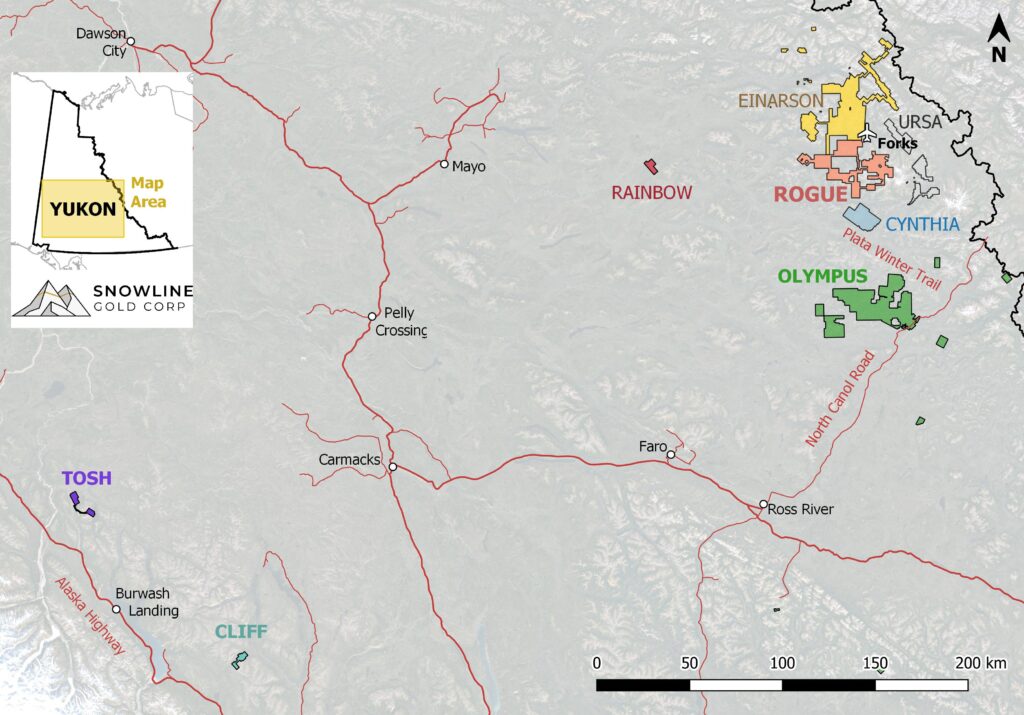

ABOUT ROGUE

The Valley target on Snowline’s flagship Rogue Project is a newly discovered, bulk tonnage style, reduced intrusion-related gold system (RIRGS), with geological similarities to multi-million-ounce deposits currently in production such as Kinross’s Fort Knox Mine in Alaska and Victoria Gold’s Eagle Mine in the Yukon. Early drill results demonstrate unusually high gold grades for such a system, present near surface across drill intersections of hundreds of metres. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays within and along the margins of a one-kilometer-scale, mid-Cretaceous aged Mayo-suite intrusion. Valley is an early-stage exploration project without a resource estimate, and while initial results are encouraging, the presence or absence of an economically viable orebody cannot be determined until additional work is completed.

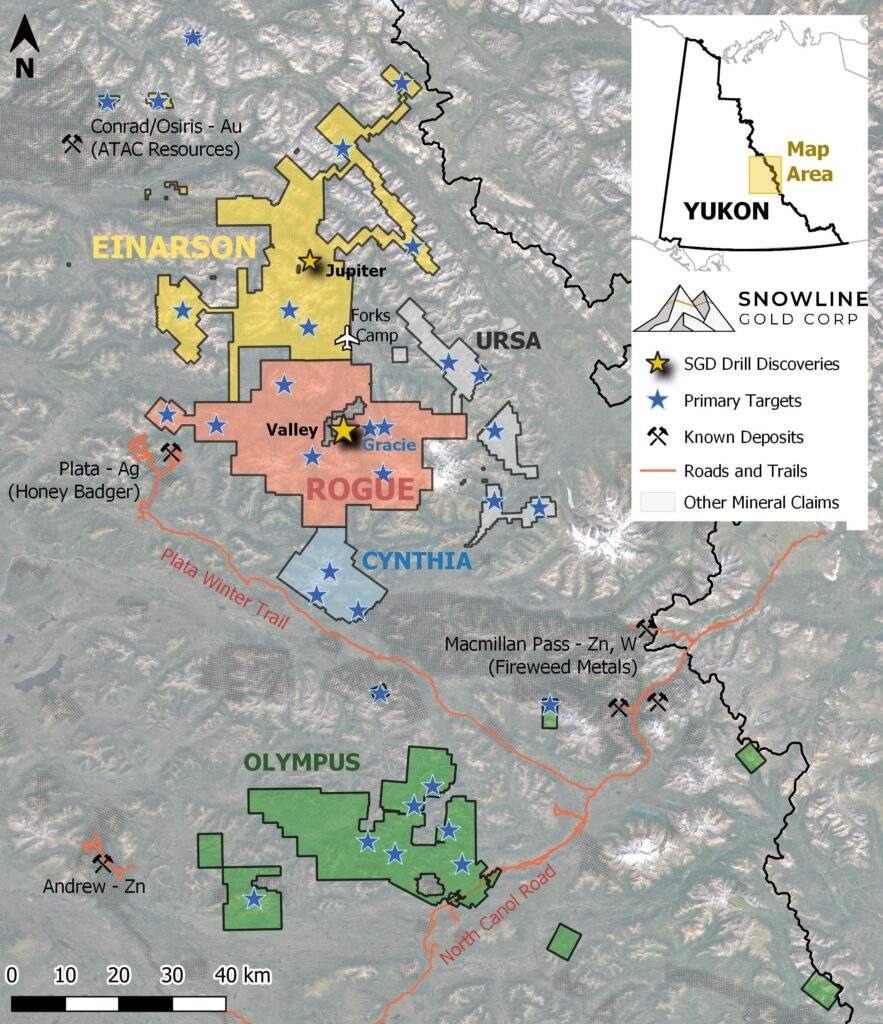

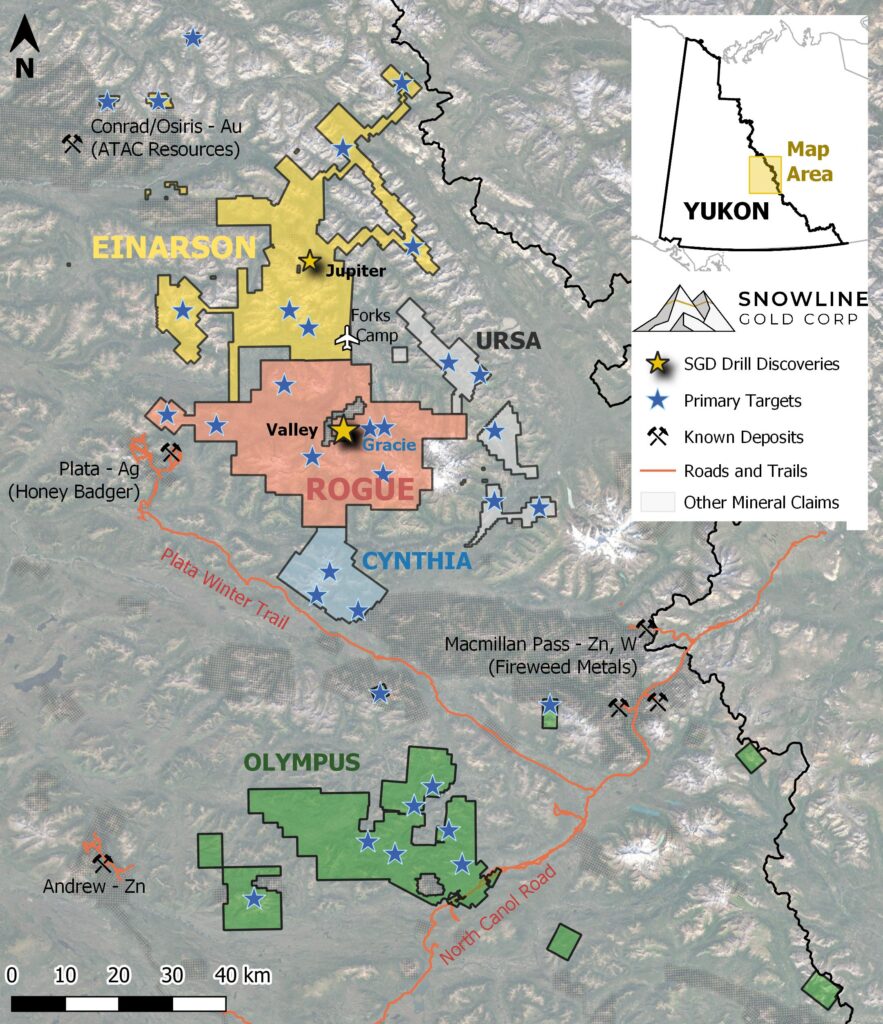

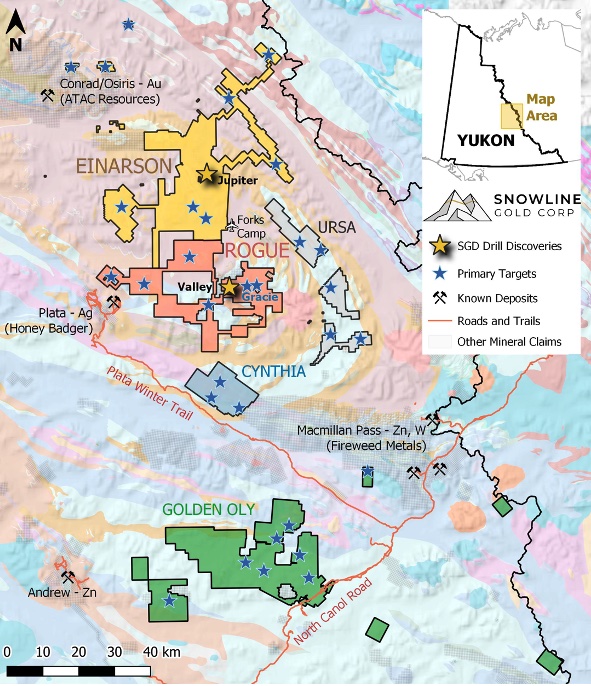

The Rogue Project area hosts multiple intrusions similar to Valley along with widespread gold anomalism in stream sediment, soil and rock samples. Elsewhere, RIRGS deposits are known to occur in clusters. The Rogue Project is thus considered by the Company to have district-scale potential for additional reduced intrusion-related gold systems.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with an eight-project portfolio covering >333,000 ha. The Company is exploring its flagship >94,000 ha Rogue gold project in the highly prospective yet underexplored Selwyn Basin. Snowline’s project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross’ Fort Knox mine, Newmont’s Coffee deposit, and Victoria Gold’s Eagle Mine. The Company’s first-mover land position and extensive database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

Figure 5 – Project location map for Snowline Gold’s eastern Selwyn Basin properties: Rogue, Einarson, Ursa, Cynthia and Olympus. The current work program at Rogue is based from the Company’s Forks Camp.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by Thomas K. Branson, M.Sc., P. Geo., Vice President of Exploration for Snowline Gold as Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the significance of analytical results, the discovery potential within the Valley intrusion, the potential for investors to participate in multiple future discoveries, the Rogue project having district-scale prospectivity, the creation of a new gold district and the Company’s future plans and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company’s plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.